Porter's Five Forces Analysis Tutorial

- the most popular analysis tool for industry competition strategy

The Porter Five Forces analysis model first appeared in a Harvard Business School professor Michael E Porter published in Harvard Business Review in 1979. The publication of this paper has historically changed the understanding of strategy among enterprises, organizations, and even countries. It was named one of the ten most influential papers of Harvard Business Review since its inception.

A Five Forces analysis can help companies assess industry attractiveness, how trends will affect industry competition, which industries a company should compete in—and how companies can position themselves for success.

Five Forces Analysis is a strategic tool designed to give a global overview, rather than a detailed business analysis technique. It helps review the strengths of a market position, based on five key forces. Thus, Five Forces works best when looking at an entire market sector, rather than your own business and a few competitors.

What is Five Forces Model?

The main idea of this model is that the key to an enterprise obtaining a competitive advantage lies in the profitability (industry attraction) of the industry in which the enterprise is located and the relative competitive position of the enterprise in the industry. Therefore, the primary task of strategic management is to select potentially highly profitable industries by analyzing five factors including suppliers, buyers, current competitors, alternative products, and potential entrants. After selecting industries, enterprises should choose one of three strategies, such as low-cost, production dissimilation or centralization, as their own competitive strategy, based on their own strength and the comparison of the five forces.

Porter's five-force analysis model has a global and profound impact on corporate strategy formulation. Applying it to the analysis of competitive strategy can effectively analyze the customer's competitive environment. Its application range from the initial manufacturing industry gradually covers almost all industries such as financial services, high technology and so on.

The Porter Five Forces model brings together a large number of different factors in a simple model to analyze the basic competitive landscape of an industry. The Potter Five Forces model identified five main sources of competition, namely:

- Bargaining power of suppliers

- Bargaining power of Buyers

- Threat of New Entrants

- The threat of Substitutes

- Competition of existing competitors in the industry

(A) The bargaining power of suppliers

When the input elements provided by the supplier constitute a large proportion of the total cost of the product to the buyer, potential bargaining power of the supplier is greatly increased. In general, suppliers who meet the following conditions will have stronger bargaining power.

- The supply-side industry is for some companies that have a relatively stable market position and are not plagued by fierce competition in the market.

- Supply-side products have certain characteristics, buyers are difficult to convert, or conversion costs are too high

- The supplier facilitates forward integration, or otherwise impose additional cost to the production process

(B) The bargaining power of buyers

Buyers mainly influence the profitability of existing companies in the industry through their ability to lower prices and requirements to provide higher product or service quality. In general, buyers who meet the following conditions have strong bargaining power:

- The total number of buyers is small, and each buyer purchases a large amount and accounts for a large percentage of the seller's sales

- The seller's industry consists of a large number of relatively small companies

- The purchaser purchases a standardized product, and it is economically feasible to purchase the product from multiple vendors at the same time.

- Suppliers facilitate forward integration, while buyers find it difficult to combine or integrate backward.

(C) The threat of new entrants

New entrants, while bringing new production capacity and new resources to the industry, hope to win a place in the market that has already been divided by existing companies. This may cause competition with existing companies in raw materials and market share, resulting in the existing industry. The level of corporate profits is reduced, even threatening survival.

The severity of competitive entry threats depends on two factors: the size of the barriers to entry into new areas and the expected response of existing businesses to entrants.

Barriers to entry mainly include the following factors:

Economies of scale

With the expansion of business scale, the industrial characteristics of the decline in unit product costs, the higher the industry's lowest effective scale, the greater the barriers to entry.

Differentiation degree

Differentiation refers to the unique targeting of products and services to customer needs. The higher the difference, the greater the barrier to entry.

Conversion cost

The conversion cost of a customer or buyer refers to the extra cost that the customer must pay in order to change the supplier.

Technical obstacles

Includes patented technology, proprietary technology and learning curve.

Control of sales channels

The company's self-built distribution channels, good partnerships and reputation, brands, etc.

Policy and Law

National policies protect certain industries, such as the financial industry.

(D) The threat of Substitutes

Two companies in different industries may generate competing products because of the products they produce are alternative products.

- Increased selling price and profitability of existing products will be limited due to the existence of alternatives that can be easily accepted by users.

- Due to the intrusion of alternatives, existing companies must improve product quality or reduce costs.

- The intensity of competition from producers of alternative products is affected by the cost of the conversion of product buyers.

(E) Competition among existing competitors in the industry

Enterprises in most industries are closely linked to each other's interests. As part of their overall strategy, their goal is to make their own companies more competitive than their competitors. There are conflicts and confrontations, often manifested in prices, advertising, product introductions, and after-sales services.

Features of Porter Five Forces Tool

Porter Five Forces provides tools for in-depth analysis of the company's industry, helping companies understand the competitive environment, correctly grasp the five competitive forces facing the company, and formulate a strategy that is beneficial to the company's competitive position. In general, the Potter Five Forces model has the following characteristics:

- Competition-oriented

- Studying existing industries

- Pay attention to the profit potential of the industry

How to apply Five Forces Model?

Porter's five-force analysis model is a powerful tool for companies to conduct environmental analysis, especially industrial analysis, but it is not all of the company's strategy. Enterprise applies Porter's five-force model also needs to be balanced both internally and externally.

- Based on Porter's five forces analysis, the degree of matching of its own resources with the industry is examined. Under the conditions of intensified market competition, any enterprise has certain risks in entering unfamiliar areas. Whether to seize these opportunities, enterprises must consider their own core capabilities and advantages.

- Based on Porter's five forces analysis model, it examines market trends and the degree of strategic flexibility. There is no immutable market, and there is no strategy once and for all. Strategy formulation is a dynamic process of constant feedback and constant adjustment. It is necessary to maintain a certain degree of strategic flexibility.

- Even if there is a good strategy, it needs good strategic landing capability. The role of people in the current enterprises is becoming more and more important. Inspiring people has become the most important factor in the sustainable development of enterprises, how to design a set of effective and diversified incentive mechanism system is particularly important for employees at different levels.

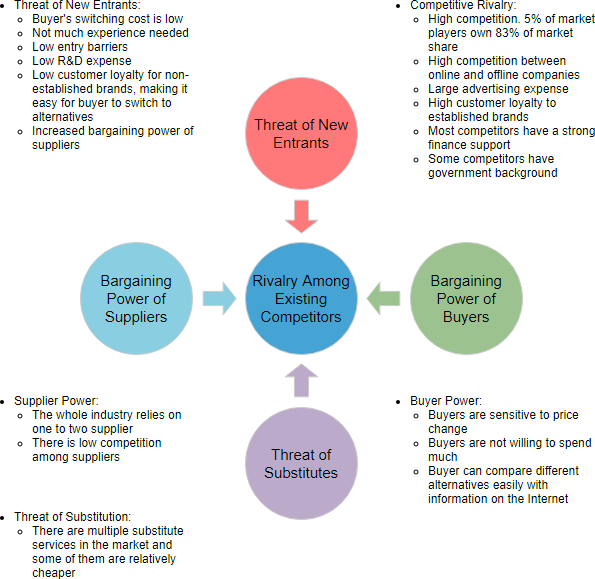

Five Forces Analysis Live Example

The Five Forces are: Threat of new market player, threat of substitute products, power of customers, power of suppliers, industry rivalry which determine the competitive intensity and attractiveness of a market.

(Click-to-open. No Installation & Setup)

Looking for a Five Forces Analysis tool?

Visual Paradigm Online supports online strategic analysis tool for you to quickly draw professional SWOT, PEST, Value Chain, Five Forces, and other strategic analysis diagrams.

Draw Now