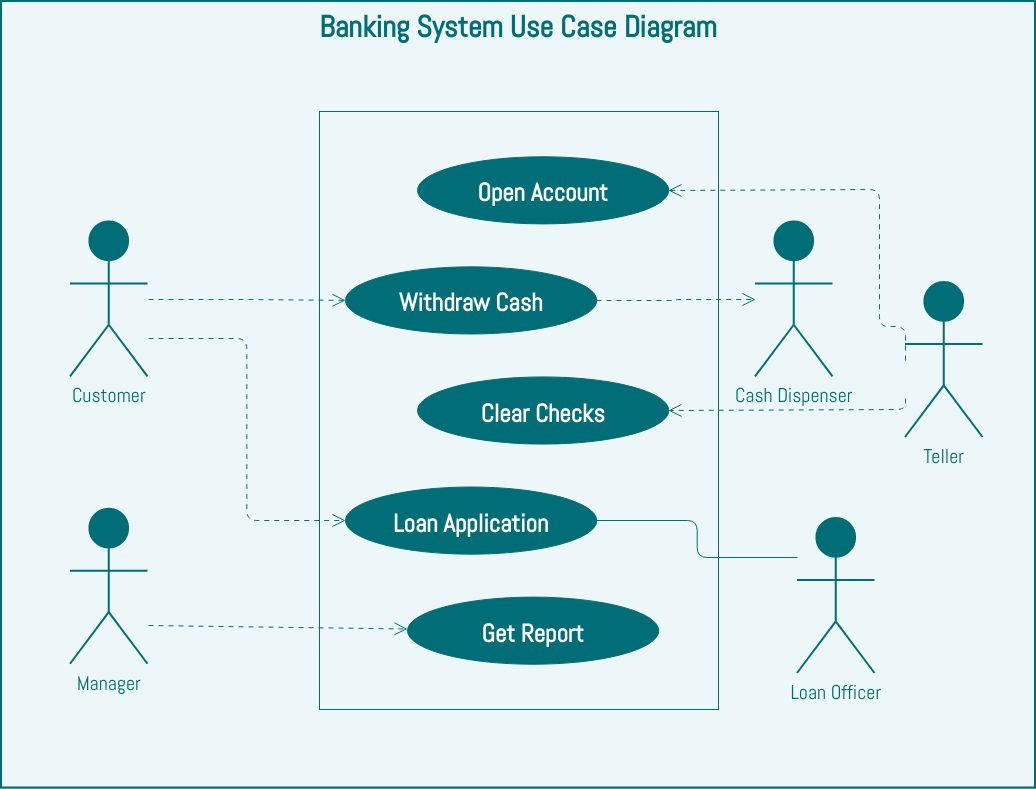

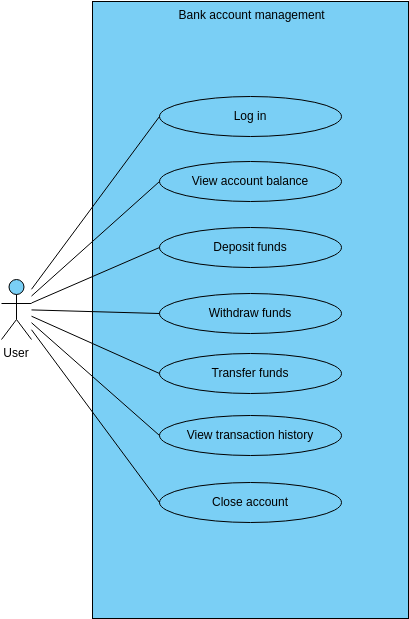

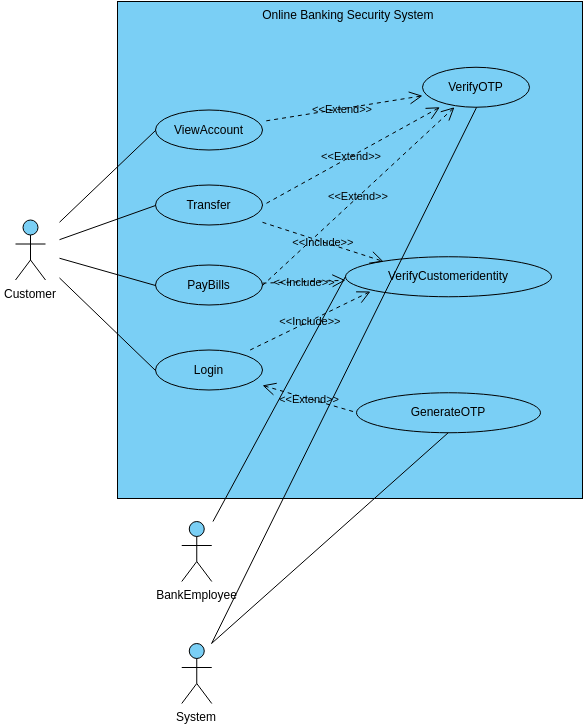

The Use Case Diagram for the Banking System outlines the various use cases involved in using the banking system. One of the key use cases is opening an account. This involves creating a new account for a customer, which includes collecting personal information, such as name, address, and contact details. The system should also be able to verify the customer's identity and provide them with an account number and other relevant information. By providing a user-friendly interface for opening an account, the banking system can help ensure that customers have a positive experience and are more likely to continue using the bank's services.

Another important use case for the banking system is withdrawing cash. This involves allowing customers to access their funds through an ATM or by visiting a branch. The system should be able to verify the customer's identity and determine their account balance before allowing them to withdraw cash. By providing a secure and efficient system for withdrawing cash, the banking system can help ensure that customers have access to their funds when they need them.

Clearing checks is another important use case for the banking system. This involves processing checks that have been deposited into a customer's account and verifying that the funds are available. The system should be able to detect fraudulent checks and prevent them from being cleared. By providing a reliable and efficient system for clearing checks, the banking system can help ensure that customers can conduct business transactions with confidence.

The banking system should also be able to handle loan applications. This involves providing customers with a user-friendly interface for applying for loans, including personal loans, car loans, and mortgages. The system should be able to evaluate the customer's creditworthiness and provide them with a loan amount and interest rate that is appropriate for their financial situation. By providing a comprehensive loan application system, the banking system can help customers achieve their financial goals and build a positive relationship with the bank.

Benefits of creating this use case diagram

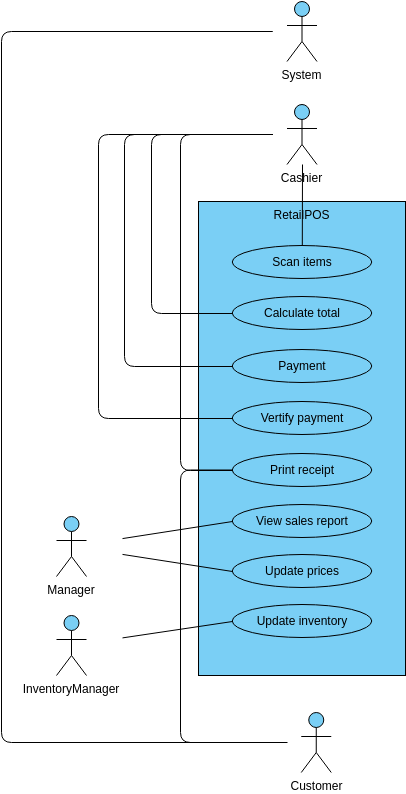

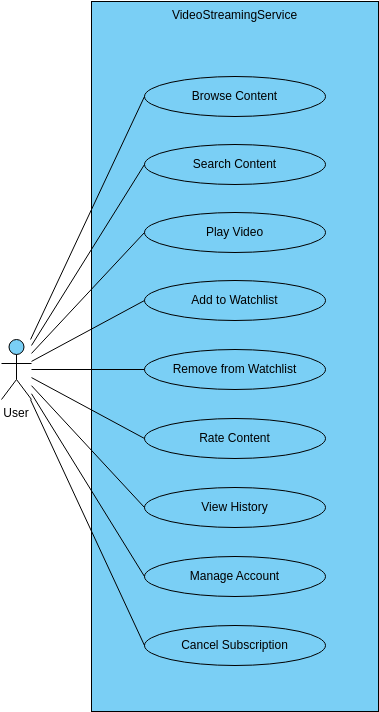

Creating a use case diagram for the Banking System provides a number of benefits. One of the key benefits is that it helps to ensure that all stakeholders have a shared understanding of how the system will function. By breaking down the system into individual use cases, it becomes easier to identify potential issues and gaps in functionality. This can help to prevent misunderstandings and ensure that the system meets the needs of all stakeholders, including customers, bank employees, and management.

Another benefit of creating a use case diagram is that it can help to improve the overall efficiency and effectiveness of the system. By identifying individual use cases and breaking them down into smaller tasks, it becomes easier to optimize each task for maximum efficiency. For example, the use case for clearing checks might be broken down into tasks such as verifying the authenticity of the check, verifying the customer's account balance, and clearing the funds. By optimizing each task, the banking system can ensure that transactions are processed quickly and accurately, which can help to improve customer satisfaction and retention.

Searching for some use case templates? Go to Visual Paradigm Online and select some designs for customization now!