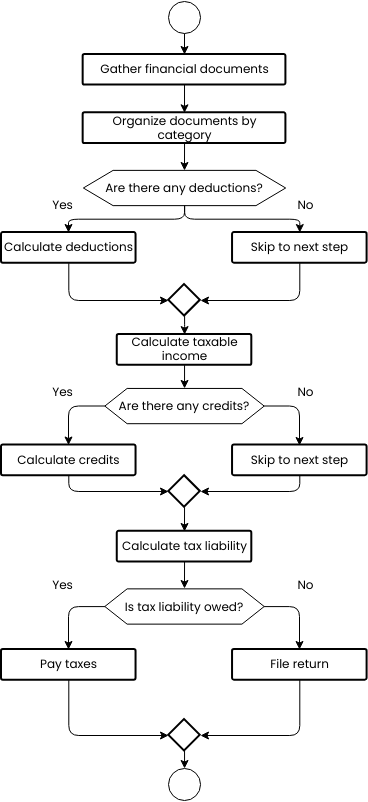

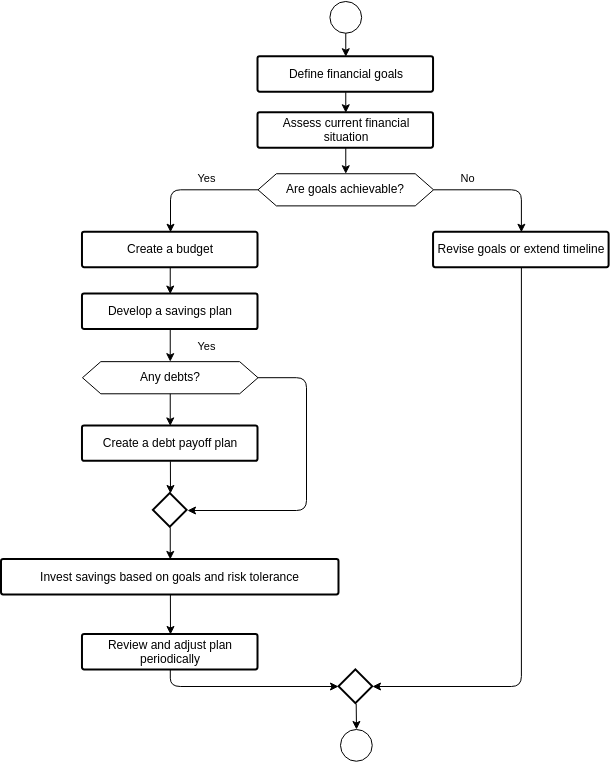

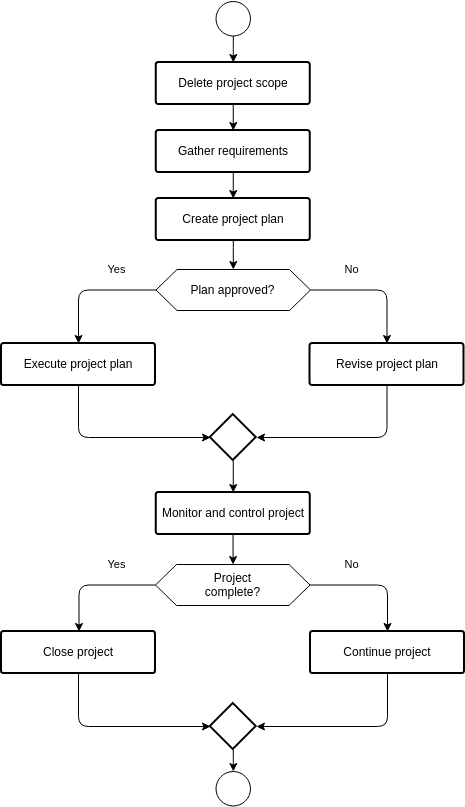

Tax preparation flowchart

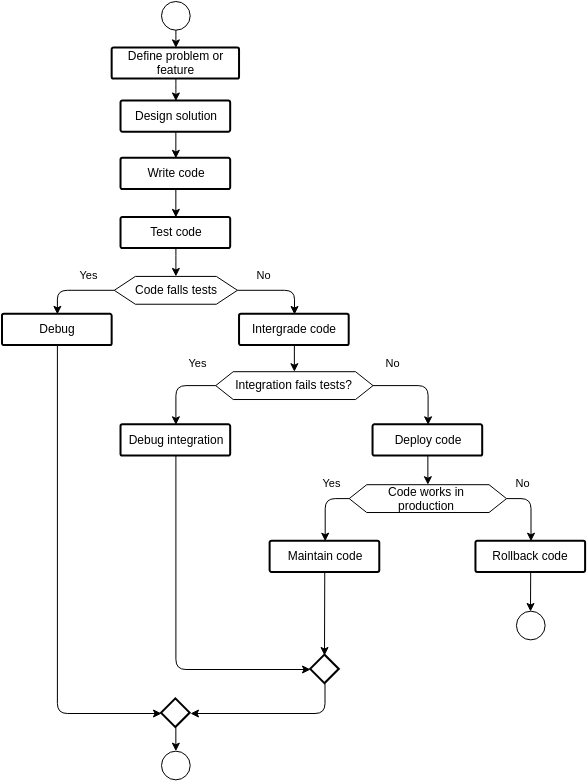

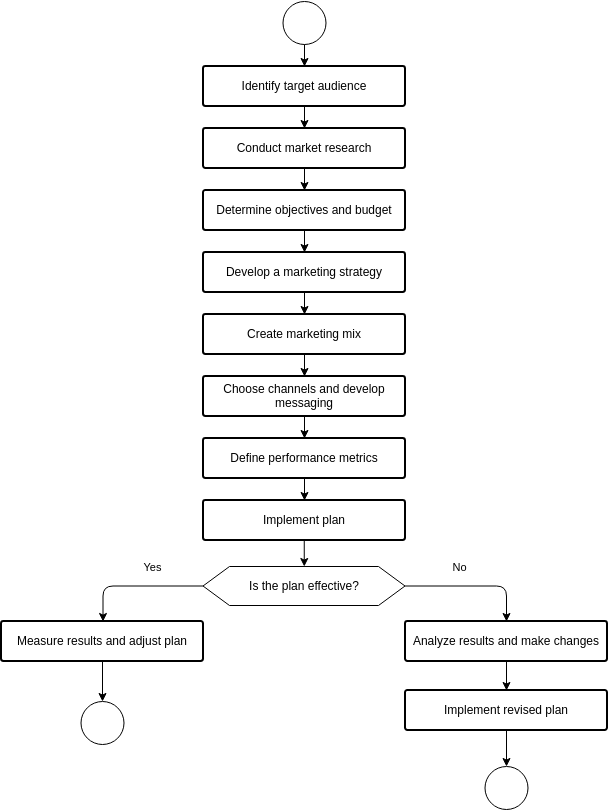

The tax preparation flowchart outlines the steps involved in preparing and filing taxes. The first step is to gather all necessary financial documents, such as W-2 forms, investment statements, and receipts. Once all necessary financial documents have been gathered, the next step is to organize them by category.

The next step in the tax preparation flowchart is to calculate deductions. This involves determining which deductions the taxpayer is eligible for and calculating the amount of each deduction. Once deductions have been calculated, the next step is to calculate the total tax owed.

The final step in the tax preparation flowchart is to pay taxes. This involves submitting the tax return and any payment owed to the Internal Revenue Service (IRS). By following this tax preparation flowchart, taxpayers can ensure that their tax return is accurate and complete, and that they pay the correct amount of taxes owed.

Proper tax preparation can also help taxpayers to maximize deductions and credits, resulting in lower taxes owed and improved financial outcomes. In addition, by organizing financial documents by category, taxpayers can make the tax preparation process more efficient and less time-consuming.

Overall, designing a tax preparation flowchart provides a clear and structured approach to preparing and filing taxes. By following the flowchart, taxpayers can ensure that all necessary steps are taken to prepare an accurate and complete tax return, resulting in improved financial outcomes and compliance with tax laws.

Benefits of designing this flowchart

Designing a tax preparation flowchart provides several benefits to taxpayers. First, it helps to ensure that tax returns are accurate and complete. By providing a clear and structured approach to tax preparation, taxpayers can ensure that all necessary financial documents are gathered, deductions are accurately calculated, and taxes owed are correctly determined. This can help to reduce the risk of errors or omissions in the tax return and avoid penalties or interest charges resulting from non-compliance.

Second, the tax preparation flowchart can help to improve efficiency and reduce the time and effort required to prepare taxes. By organizing financial documents by category and following a structured approach to tax preparation, taxpayers can streamline the process and reduce the time and effort required to prepare their taxes. This can free up time for other important activities and reduce the stress and burden of tax preparation.

Overall, designing a tax preparation flowchart is an important step for taxpayers to ensure that they are compliant with tax laws and that their tax returns are accurate and complete. By providing a clear and structured approach to tax preparation, taxpayers can reduce the risk of errors or omissions, improve efficiency, and achieve long-term financial success.

Do you need templates for flowchart design? Right away, go to Visual Paradigm Online to look at some of your favorite customizable templates.