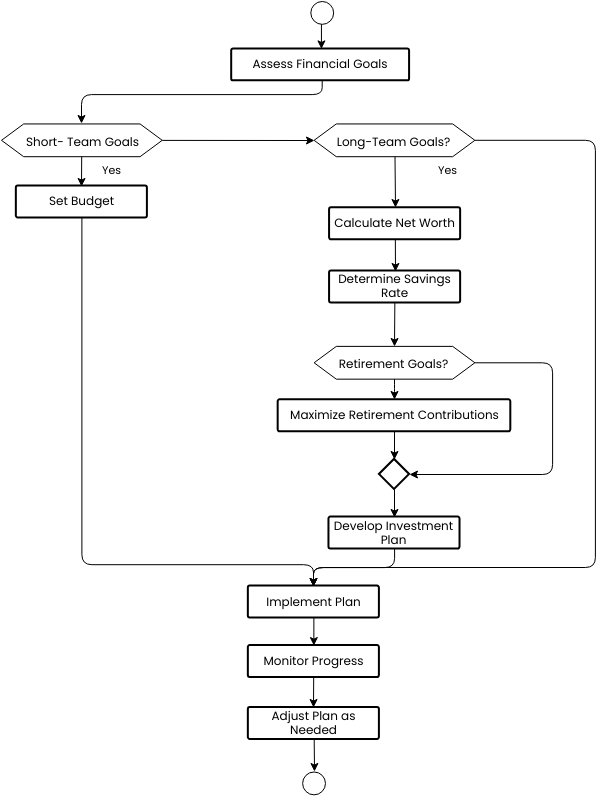

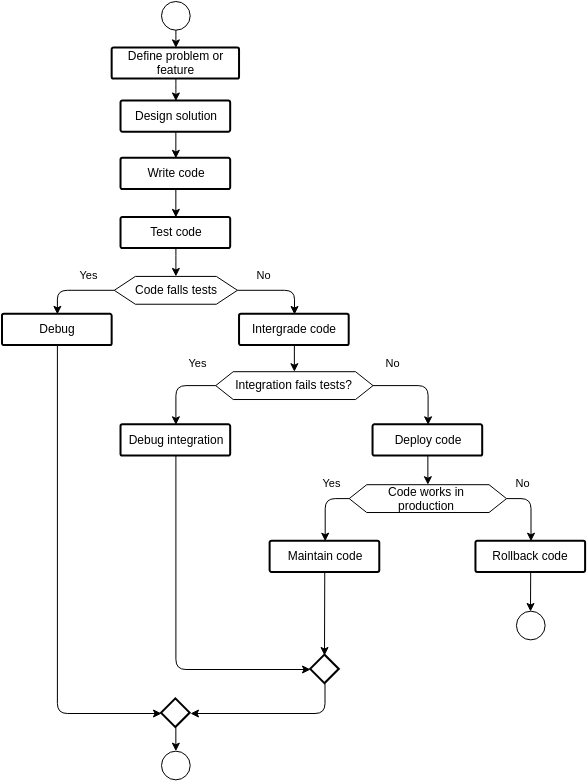

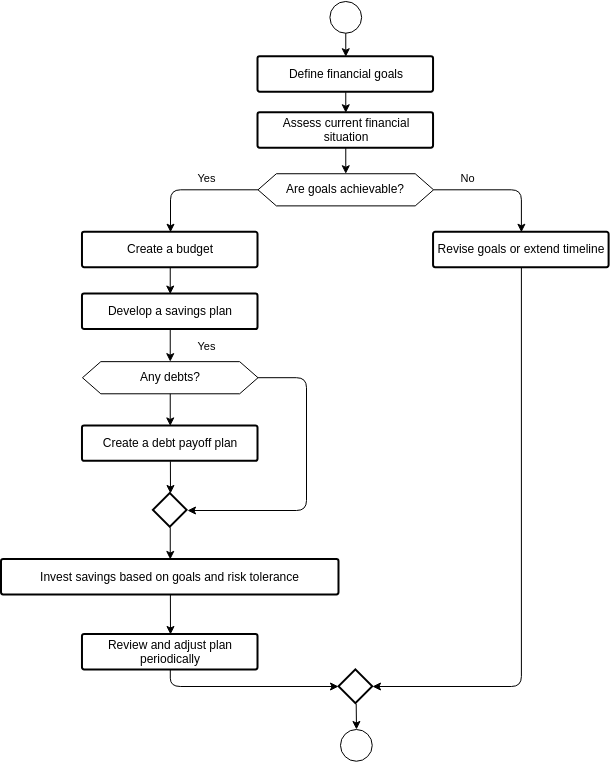

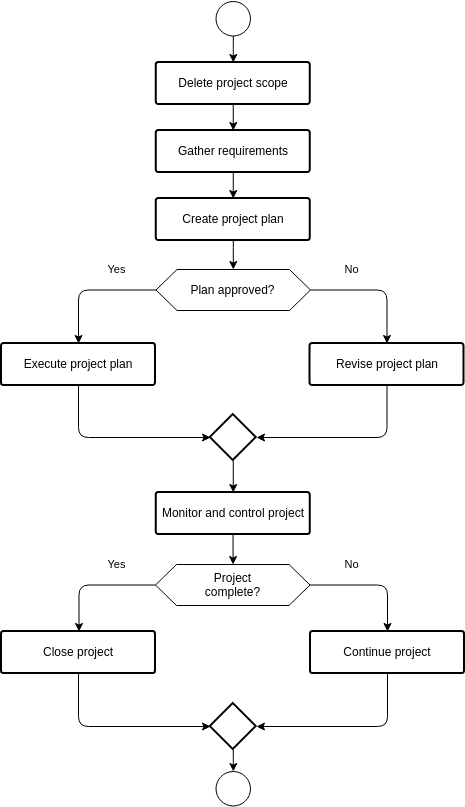

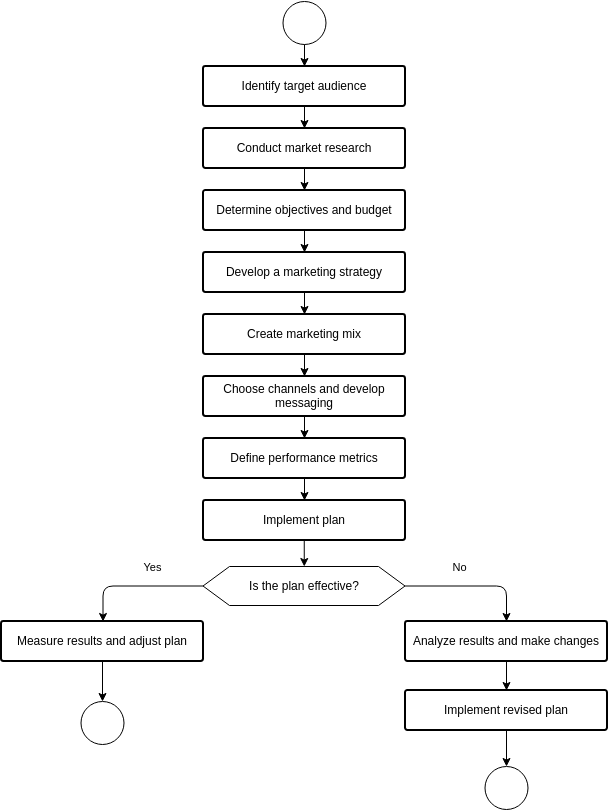

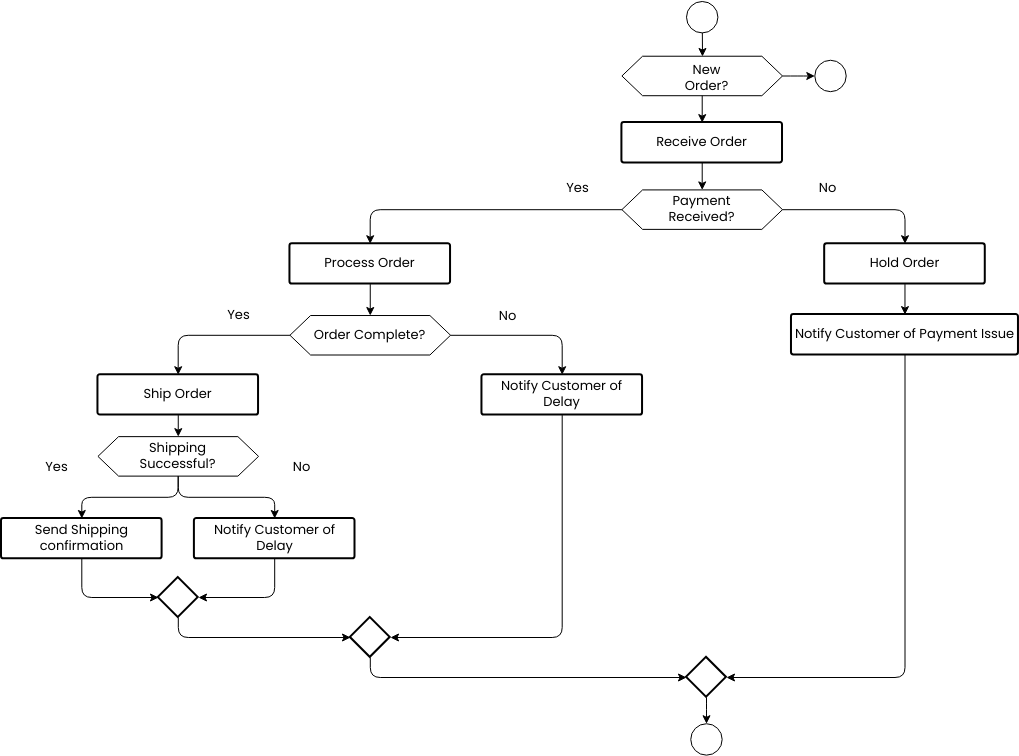

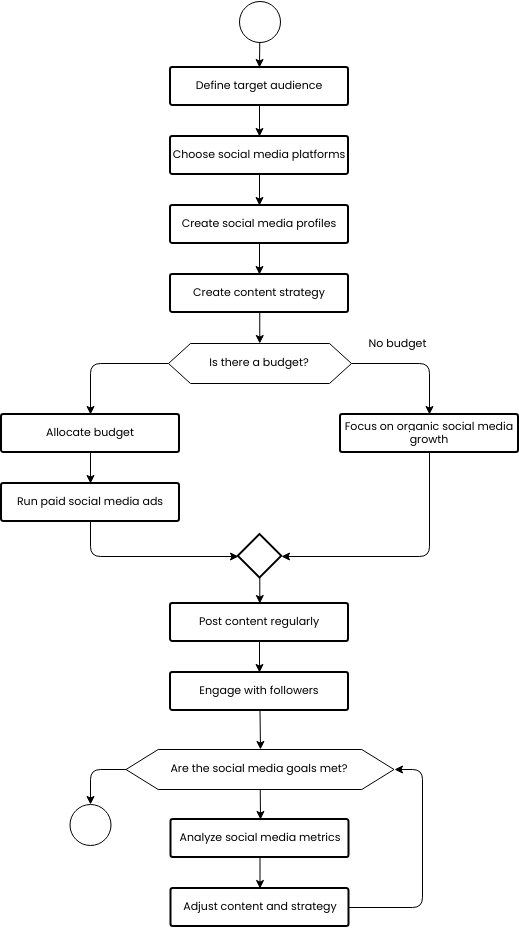

Financial planning flowchart

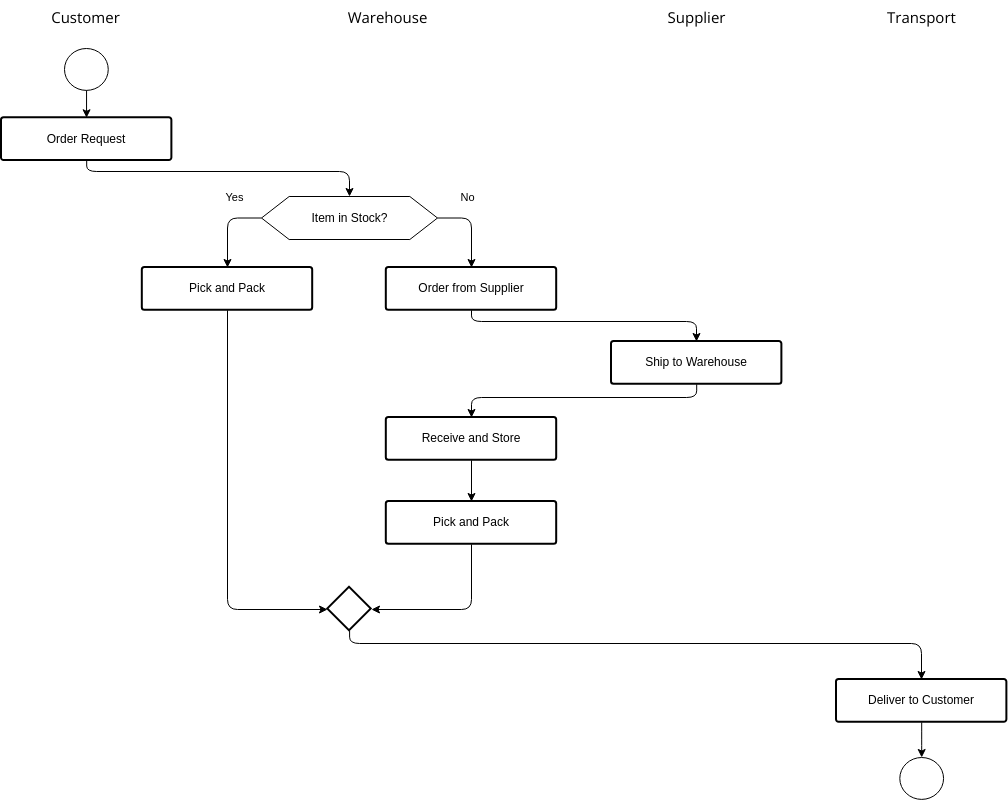

The financial planning flowchart outlines the steps involved in managing personal finances and achieving financial goals. The first step is to assess financial goals, identifying short-term and long-term objectives. The next step is to calculate net worth, determining the difference between assets and liabilities.

Once net worth has been calculated, the next step is to determine the savings rate, establishing a budget to ensure that savings goals are met. Maximizing retirement contributions is also important and involves contributing the maximum amount allowed by law to retirement accounts.

Developing an investment plan is the next step, determining the appropriate type of investments and asset allocation to achieve financial goals. Once the investment plan has been developed, it is important to implement the plan and make investment decisions in a timely and effective manner.

Finally, monitoring progress is important, reviewing investment performance and making adjustments as needed. By following this financial planning flowchart, individuals can achieve long-term financial success and security, ensuring that their personal finances are aligned with their financial goals and risk tolerance.

Benefits of creating this flowchart

First, it helps to ensure that personal finances are aligned with financial goals. By assessing financial goals, calculating net worth, and developing an investment plan, individuals can ensure that their financial resources are directed towards achieving their desired outcomes. This can help to reduce financial stress and provide a sense of financial security.

Second, the financial planning flowchart can help to improve financial decision-making and reduce the risk of financial mismanagement. By following a structured approach to financial planning and investment management, individuals can make informed decisions based on their financial goals and risk tolerance. This can help to avoid impulsive or emotional financial decisions that could negatively impact financial outcomes.

Third, creating a financial planning flowchart can help to enhance financial awareness and empower individuals to take control of their personal finances. By understanding their net worth, savings rate, and investment strategy, individuals can make informed decisions and take proactive steps towards achieving their financial goals.

Do you need templates for flowchart design? Right away, go to Visual Paradigm Online to look at some of your favorite customizable templates.