The BCG matrix was created by the Boston Consulting Group also known as the Boston or growth-share matrix which is a planning tool that uses graphical representations of a company’s products and services to help the company decide what it should keep, sell or invest more in. The matrix has been used since 1968 to help companies gain insights on what products best help them capitalize on market share growth opportunities.

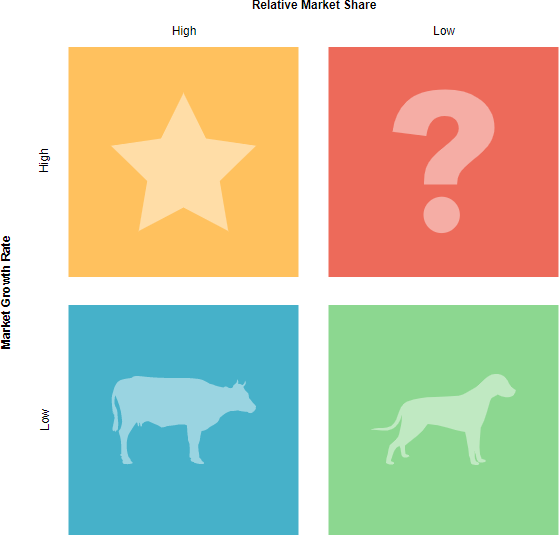

The matrix plots a company’s offerings in a four-square matrix as shown below, with the y-axis representing a rate of market growth and the x-axis representing market share. In other words, it showcases the product life cycle theory in a 2×2 matrix, assuming market share is the primary success factor. It is ideal for long-term strategic planning, letting you review your products or services and decide if they should be invested in or discontinued.

The Four Compartments

Stars

The business units or products that have the best market share and generate the most cash are considered stars, such as:

- Monopolies and first-to-market products are frequently termed stars. However, because of their high growth rate, stars consume large amounts of cash.

- Stars can eventually become cash cows if they sustain their success until a time when the market growth rate declines.

Possible Action:

- Companies are advised to invest in stars.

Cash Cows

Cash cows are the leaders in the marketplace and generate more cash than they consume. These are business units or products that have a high market share but low growth prospects, such as:

- Cash cows provide the cash required to turn question marks into market leaders, cover the administrative costs of the company, fund research, and development, service the corporate debt, and pay dividends to shareholders.

Possible Action:

- Companies are advised to invest in cash cows to maintain the current level of productivity or to “milk” the gains passively.

Dog

Dogs, or pets as they are sometimes referred to, are units or products that have both a low market share and a low growth rate, such as:

They frequently break-even, neither earning nor consuming a great deal of cash. Dogs are generally considered cash traps because businesses have money tied up in them, even though they are bringing back basically nothing in return.

Possible Action:

These business units are prime candidates for divestiture.

Question Marks

These parts of a business have high growth prospects but a low market share. They consume a lot of cash but bring little in return. In the end, question marks, also known as problem children, lose money, However, since these business units are growing rapidly, they have the potential to turn into stars.

Possible Action:

Companies are advised to invest in question marks if the product has the potential for growth or to sell if it does not.

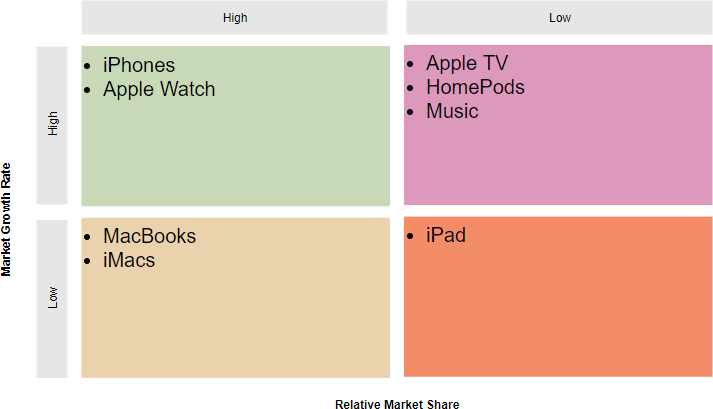

BCG Matrix – Apple Products