Why Correcting an Official’s Mistake on Your Taxes is Important?

Filing your taxes can be a stressful experience, and the last thing you want to deal with is an error made by an official that can negatively impact your finances. Unfortunately, mistakes can happen, and when they do, it’s crucial to address them promptly and correctly.

Why do we write a “Correct an Official’s Mistake on Your Taxes” letter?

When you receive a notice from the IRS or another tax authority informing you of an error on your tax return, it’s essential to act quickly to correct the mistake. Writing a “Correct an Official’s Mistake on Your Taxes” letter is an effective way to address the issue and provide evidence to support your claim.

When do we need to write a “Correct an Official’s Mistake on Your Taxes” letter?

You may need to write this type of letter if you believe an official has made an error on your tax return, such as a mistake in your income, deductions, or credits. You may also need to write this letter if you disagree with a decision made by the IRS or another tax authority.

Why use our letter templates?

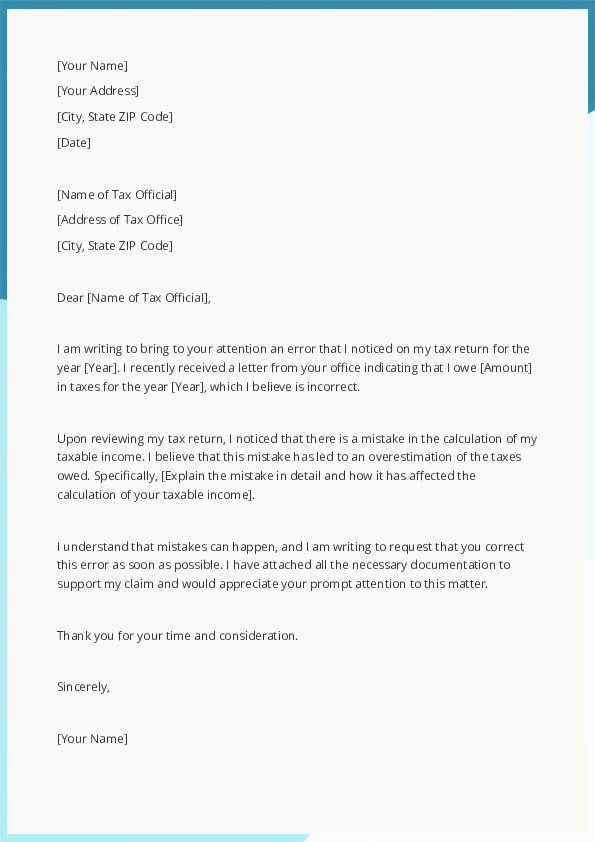

Writing a letter to correct an official’s mistake on your taxes can be challenging, especially if you are not familiar with the legal jargon and language used in tax matters. That’s where our document templates come in. Our templates are designed to make it easy for you to create a professional and effective letter that addresses the issue at hand.

By using our templates, you can ensure that your letter contains all the necessary information, including your personal details, a clear explanation of the error, and supporting evidence. This can help you avoid misunderstandings and disputes with the tax authorities and ensure that your tax return is corrected promptly.

Unleash Your Productivity Potential with Our Online Document Editor!

Are you ready to take your productivity to new heights? With our Online Document Editor at Visual Paradigm Online, you have the power to create captivating documents, letters, reports, and eBooks that will leave a lasting impact. Imagine effortlessly crafting flawless content with the help of our spell checker and grammar checker, ensuring every word shines with professionalism.