Intangible Asset Depreciation: What You Need to Know

Intangible assets, such as patents, trademarks, and copyrights, play a critical role in many businesses today. However, unlike tangible assets like buildings or equipment, intangible assets have no physical form and can’t be seen or touched. This makes it challenging to determine their value and how they depreciate over time.

One method of determining the value of intangible assets is to calculate their depreciation. Depreciation is a calculation that reflects the decline in value of an asset over time due to wear and tear, age, or obsolescence. In the case of intangible assets, depreciation is often based on the useful life of the asset, which can range from a few years to several decades.

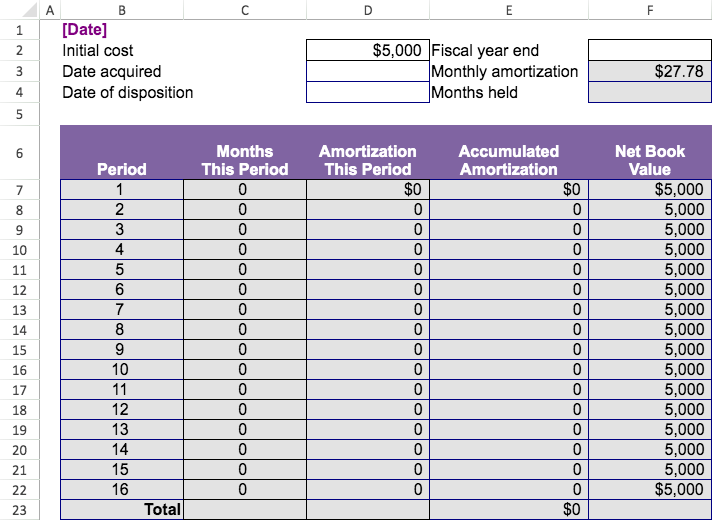

Visual Paradigm offers an easy-to-use excel template for intangible asset depreciation that allows you to quickly and accurately calculate the depreciation of your intangible assets. With this template, you can input information about your assets, such as the date acquired and expected useful life, and the template will automatically calculate the depreciation for each year. This helps you better understand the value of your intangible assets and make informed business decisions.

In conclusion, intangible assets are a critical component of many businesses today. Depreciation is a valuable tool for determining the value of these assets and ensuring that they are appropriately accounted for on your company’s balance sheet. If you are looking for an easy and accurate way to calculate intangible asset depreciation, be sure to check out Visual Paradigm’s intangible asset depreciation excel template.