Top 11 Highlights From Berkshire Hathaway's 2021 Annual Shareholder Meeting Infographic

11 Key Highlights of Berkshire Hathaway's 2021 Shareholder Meeting

Buffett and Munger, chairman and vice chairman of Berkshire Hathaway, attended the company's annual shareholders' meeting in early May and responded to shareholders' questions. Here are the investment points they mentioned at the meeting:

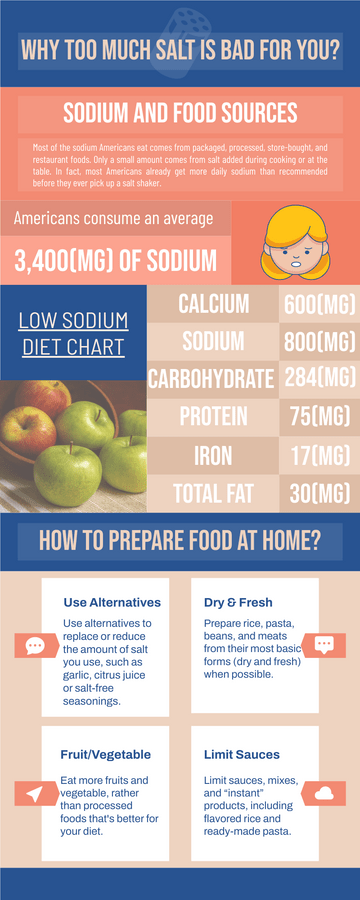

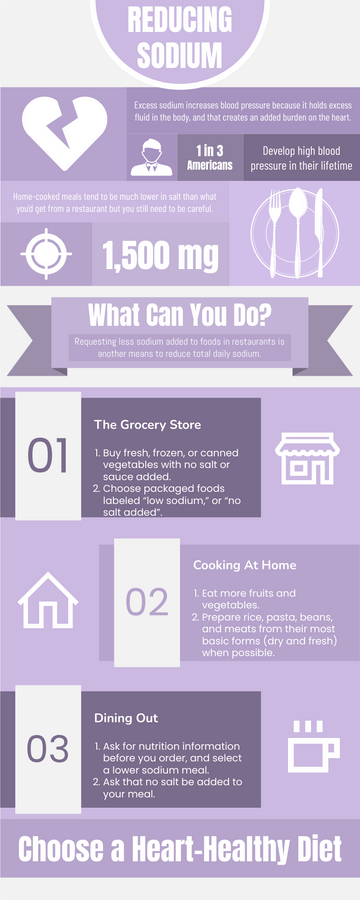

The U.S. economy is recovering well: Thanks to fiscal actions by the Federal Reserve and Congress, the U.S. economy is continuing to recover "in a very efficient way," with inflation rising, housing costs and steel costs rising daily, and Buffett said. "This economy, right now, 85 percent of it is running in super high gear."

Berkshire has been struggling to find a major acquisition: Berkshire still has $145.439 billion in cash and short-term investments because Mr. Buffett has struggled for years to find major acquisitions for the company. The special-purpose acquisition company (SPAC) boom is a killer that will hamper Berkshire’s ability to do deals, but the SPAC boom won't last forever.

It was a bad decision to sell Apple: Admitted that it was a mistake to sell down its Apple stake last year and that it was a flop on Haven, a health care company.

Will not repurchase airline stocks: The airline's shares were sold out last year, but they will not be bought because of the downturn in international travel.

U.S. bank sector is not a bad investment: Although he has reduced his bank holdings in the past year, Buffett said he still likes the banking sector in general but doesn't want to take too much risk, but still thinks the U.S. banking sector is in far better shape than banks elsewhere.

For individual investors, index funds may be a good choice: Don't assume that investing is an easy way to get rich. Choosing large companies to invest in is more complicated than understanding the growth prospects of an industry. The world can change dramatically at any time, so investing in index funds is the best way to do it.

Buffet dislikes Bitcoin: Bitcoin is a disgusting and antithetical invention to the interests of civilization, and Buffett says he hates its success.

We still need hydrocarbon fuel: The world will still need a lot of hydrocarbon fuel for a long time. Warren Buffett: “Chevron's not an evil company in the least”

Greg Abel - Warren Buffett's successor: The replacement for Berkshire hasn't been announced yet, but Munger mentioned at the meeting that Greg Abel will continue Berkshire's culture.

Raising corporate taxes may not be that bad: The Biden administration's proposed increase in the corporate tax rate would be bad for shareholders, but not particularly worrying because businesses will always adjust.

The world will still need hydrocarbon fuels for a long time to come: Mainland China has discovered how to successfully build thriving companies, but the US will still have more of the most valuable companies than mainland China.