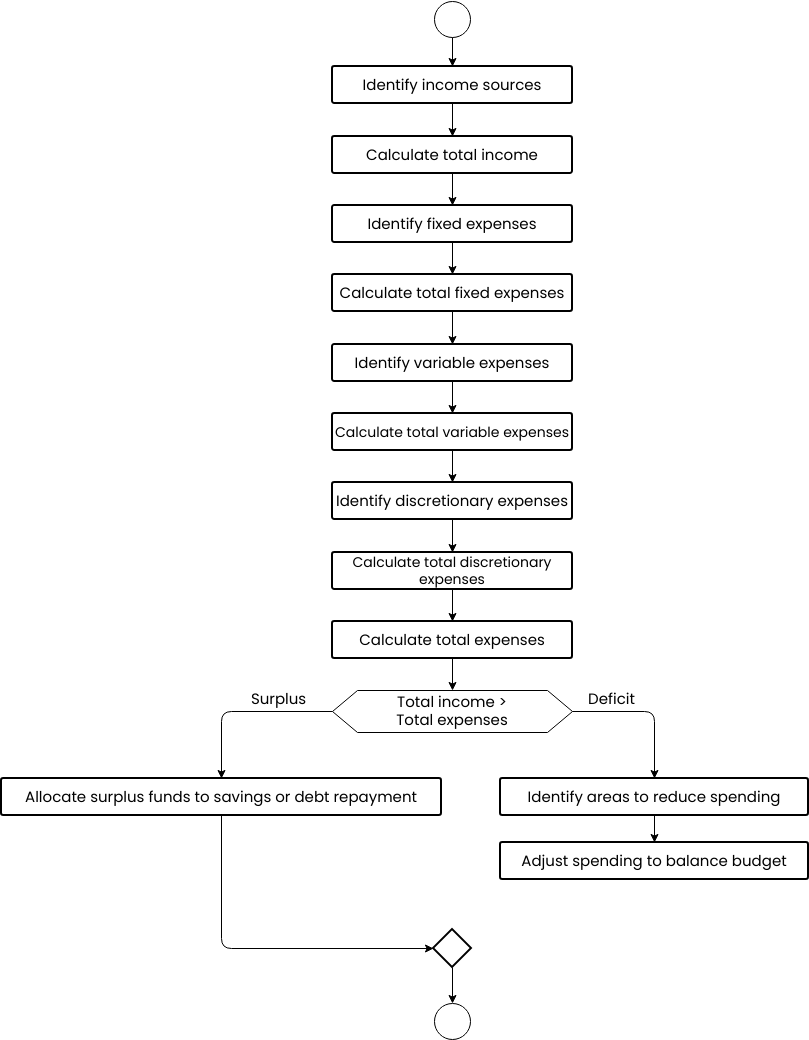

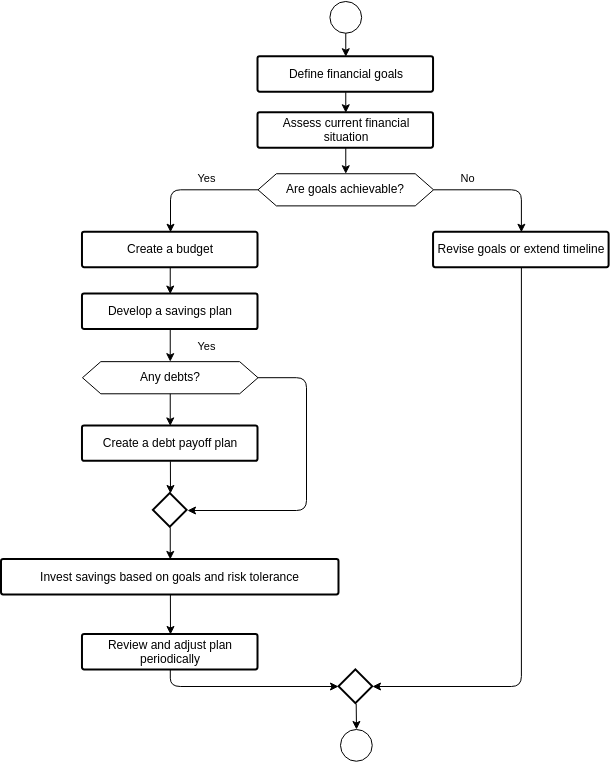

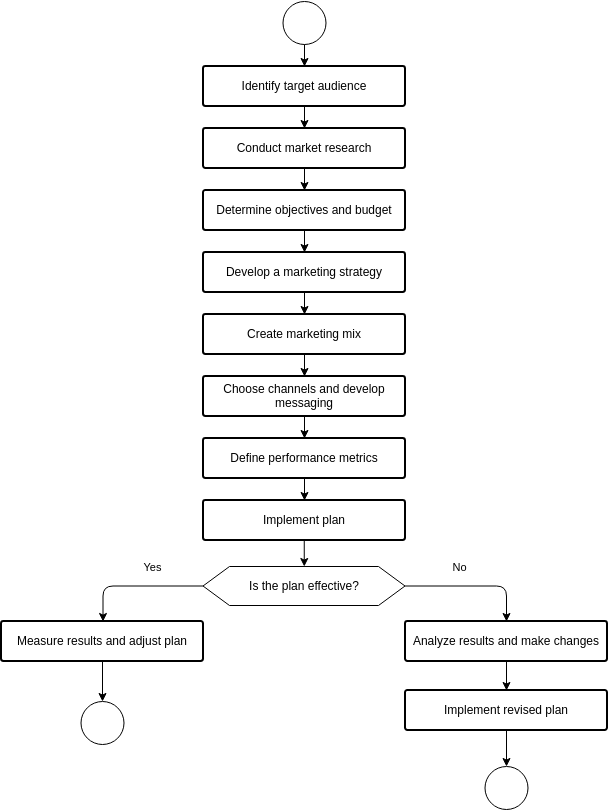

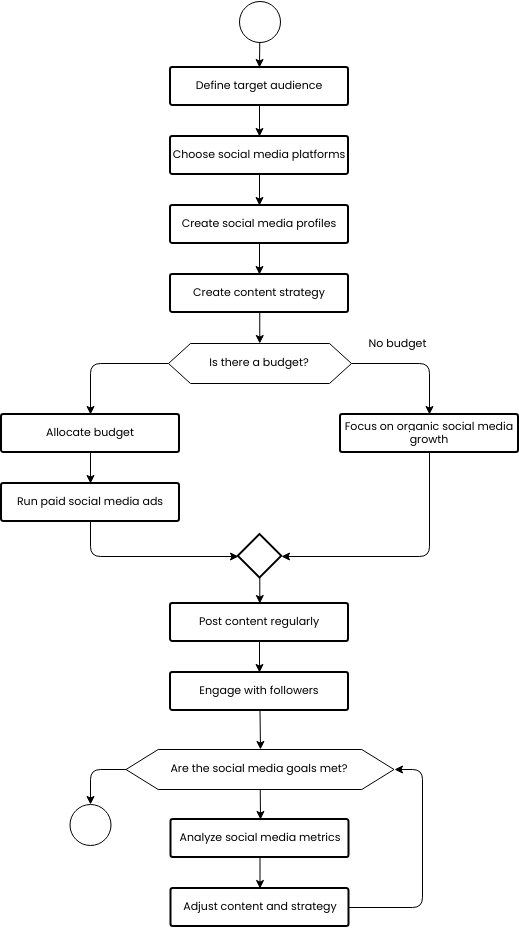

Budgeting Flowchart

The Budgeting Flowchart outlines the steps involved in creating a budget. These steps include identifying income sources, calculating total income, identifying fixed, variable, and discretionary expenses, calculating total expenses, identifying areas to reduce spending, and adjusting spending to balance the budget.

By identifying income sources, individuals or businesses can ensure that they have an accurate understanding of their total income. Calculating total income involves adding up all income sources to determine the total amount of income for a given period. This helps individuals or businesses understand how much money they have available to allocate towards expenses.

Identifying fixed expenses involves identifying expenses that remain constant from month to month. These expenses may include rent, mortgage payments, or insurance premiums. Calculating total fixed expenses involves adding up all fixed expenses to determine the total amount of money that must be allocated towards those expenses each month.

During the budgeting process, it is also important to identify and calculate variable and discretionary expenses. Variable expenses are expenses that can change from month to month, such as utility bills or grocery bills. Discretionary expenses are non-essential expenses, such as entertainment or dining out. By identifying and calculating these expenses, individuals or businesses can understand where their money is going and identify areas to reduce spending.

Finally, it is important to calculate total expenses and identify areas to reduce spending in order to balance the budget. By comparing total expenses to total income, individuals or businesses can determine if they are spending more money than they are earning. If this is the case, they can identify areas to reduce spending and adjust their spending habits to balance their budget.

Overall, the Budgeting Flowchart provides a framework for individuals or businesses to create a budget that aligns with their financial goals and helps them achieve long-term financial success. By following the steps outlined in the flowchart, individuals or businesses can identify income sources, allocate resources to fixed and variable expenses, identify areas to cut spending, and balance their budget. A well-managed budget can result in reduced stress, increased financial stability, and improved overall quality of life.

Pros of creating this budgeting flowchart

Creating a Budgeting Flowchart can be very helpful for individuals or businesses. It provides a clear and easy-to-understand guide for creating a budget. This can help people understand how to manage their money better and find ways to save money.

By using a Budgeting Flowchart, people can follow a step-by-step process to identify their income sources, plan for fixed and variable expenses, find areas where they can cut costs, and balance their budget. This can help people feel more in control of their finances and reduce stress.

Overall, using a Budgeting Flowchart can help people manage their money better, save money, and have more financial security. By following a clear process, people can make better decisions about how to spend their money and achieve their financial goals.

Do you need templates for flowchart design? Right away, go to Visual Paradigm Online to look at some of your favorite customizable templates.