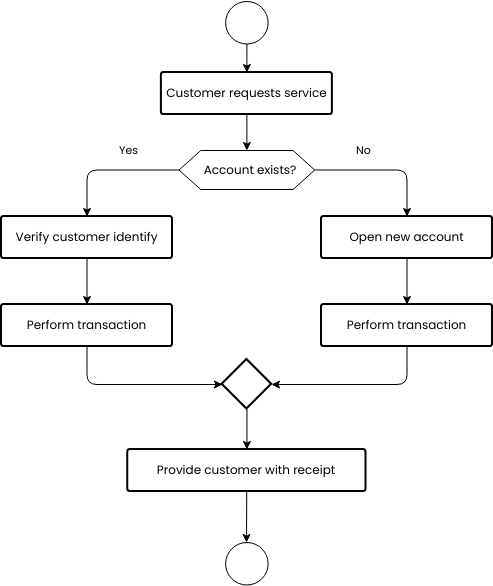

Banking process flowchart

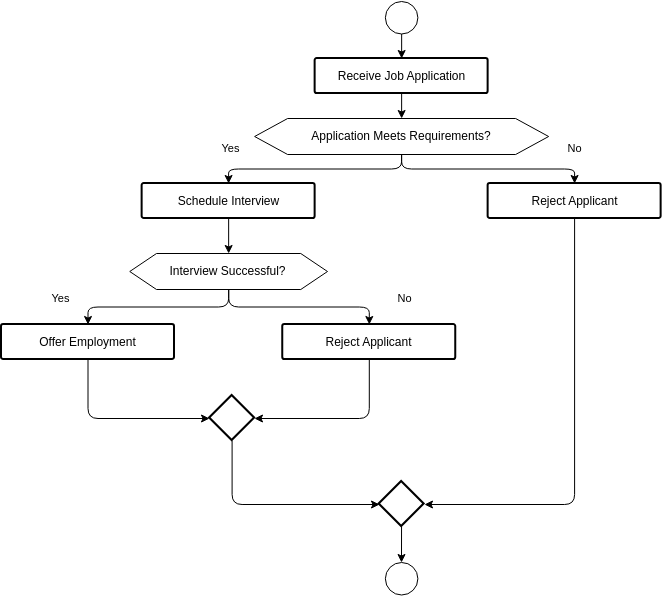

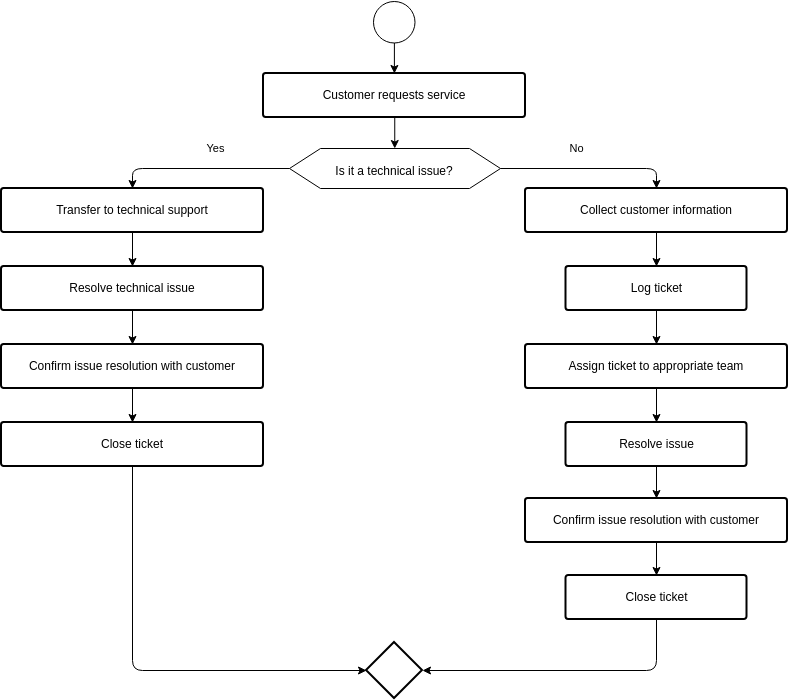

The Banking Process Flowchart outlines the steps involved in providing banking services to customers. The first step is when a customer requests service, which may involve opening a new account or performing a transaction on an existing account.

If the customer is opening a new account, the next step is to gather the necessary information and documentation to open the account. This may include verifying the customer's identity, collecting their personal information, and determining the type of account that best meets their needs.

Once the account has been opened, the next step is to perform any requested transactions on the account. This may include deposits, withdrawals, transfers, or other banking services.

Throughout the process, it is important to provide the customer with a receipt for any transactions performed. This can help ensure that the customer has a record of the transaction and can be used for future reference or disputes.

Overall, the Banking Process Flowchart provides a clear and structured approach for providing banking services to customers. By following these steps, banks can ensure that they are providing a high level of service to their customers and maintaining accurate records of all transactions.

What are the benefits of creating this flowchart?

Creating a Banking Process Flowchart can provide several benefits, including ensuring that all necessary steps in the banking process are identified and followed in a logical and efficient sequence, serving as a reference tool for employees involved in providing banking services, identifying bottlenecks or inefficiencies in the process, aiding in training new employees, and serving as a valuable communication tool for stakeholders.

By providing a clear and structured overview of the banking process, the flowchart can help banks provide high-quality services to their customers, reduce errors and inefficiencies, and communicate effectively with stakeholders.