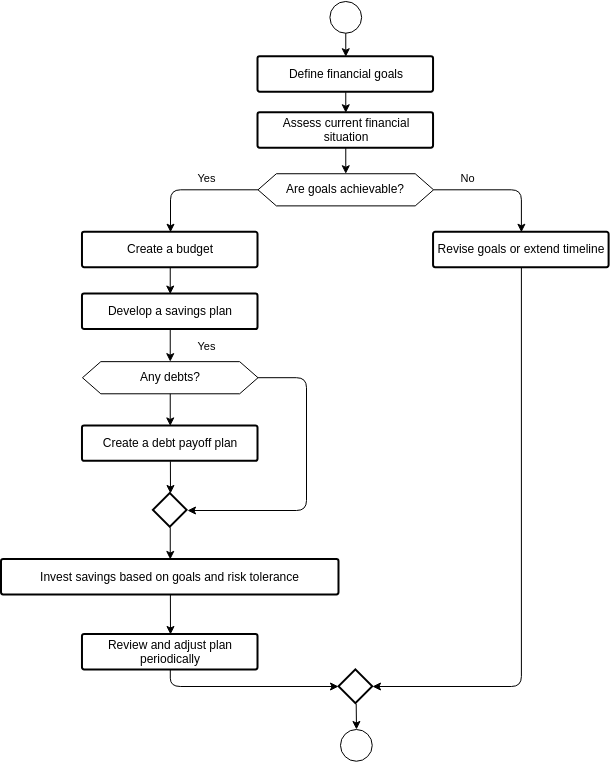

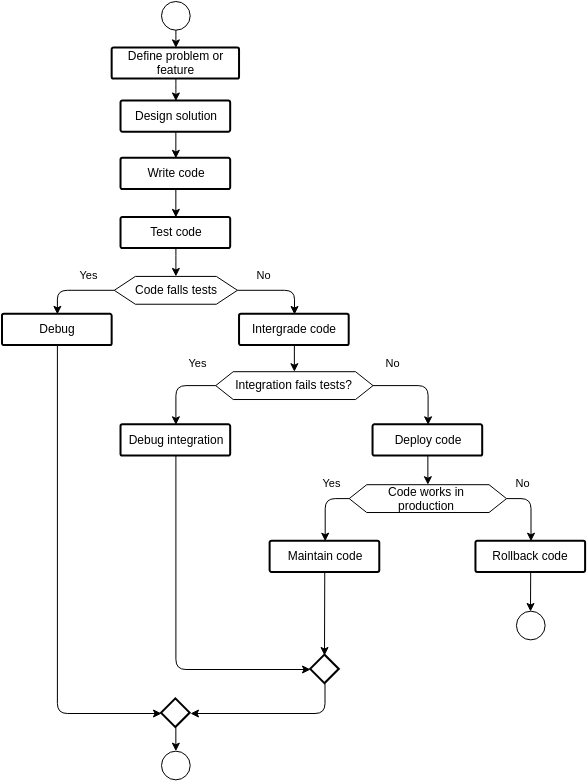

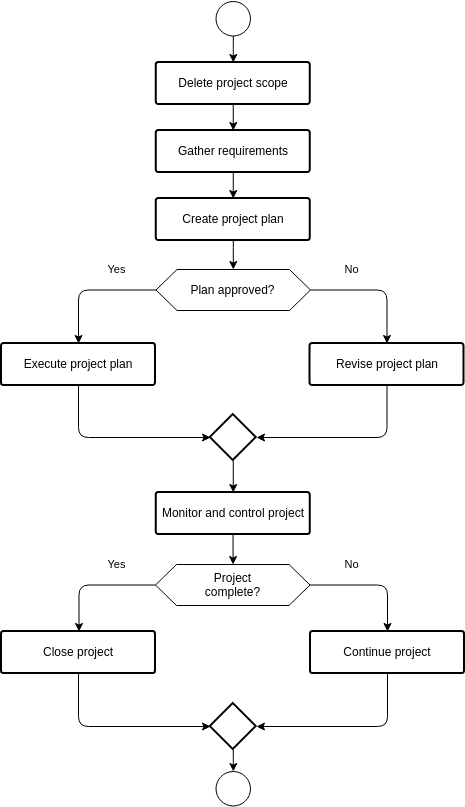

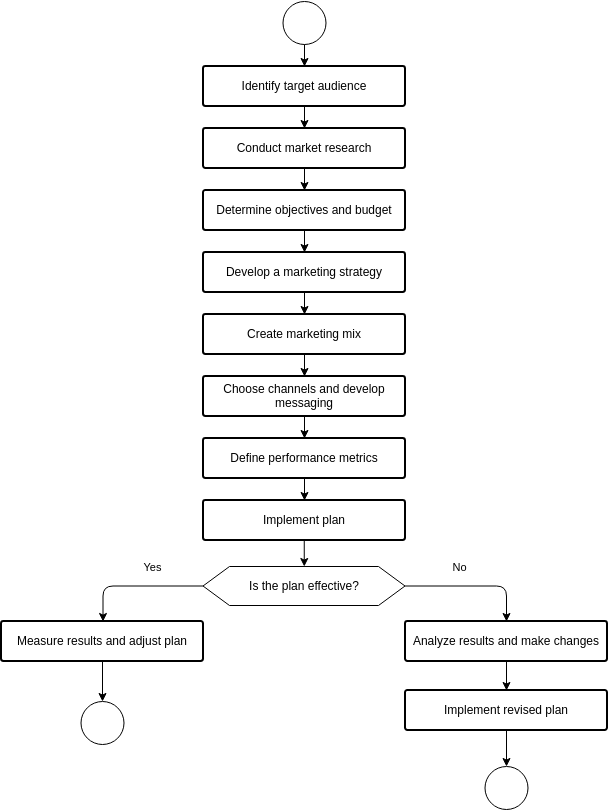

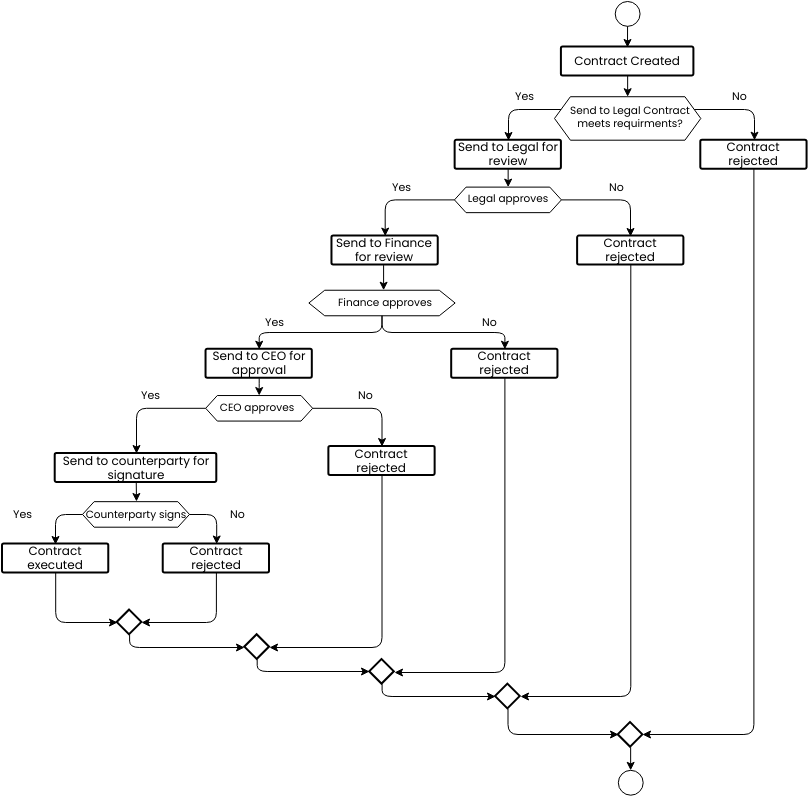

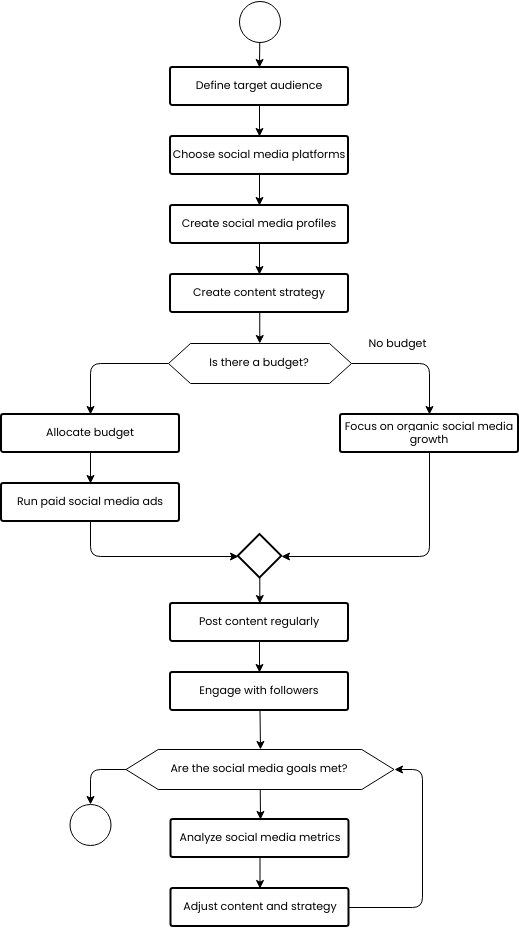

Flowchart for a financial planning process

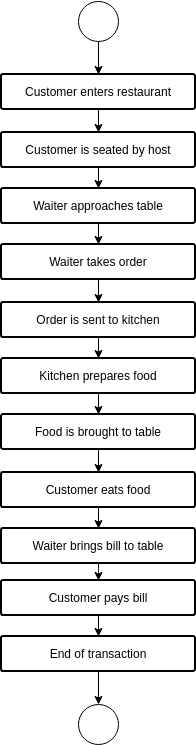

The flow chart outlines a financial planning process that can help individuals achieve their financial goals. The process begins with defining financial goals, which can include things like saving for a down payment on a home, paying off debt, or building a retirement nest egg. Once the goals are defined, the individual needs to assess their current financial situation, including income, expenses, debt, and assets.

Next, the individual should create a budget to help them manage their expenses and ensure they are living within their means. Creating a budget involves tracking expenses and identifying areas where they can cut back on spending.

After creating a budget, it's important to develop a saving plan to help achieve the financial goals. This involves setting aside a portion of income each month to save for the goals identified earlier. The saving plan should be realistic and achievable, and the individual should track their progress regularly.

For those with debt, the next step is to create a debt payoff plan. This involves prioritizing debts and creating a plan to pay them off as quickly as possible. This can include strategies like paying off high-interest debt first or consolidating multiple debts into a single payment.

Once the individual has established a solid financial foundation by managing their expenses, saving, and paying off debt, they can begin to invest their savings based on their goals and risk tolerance. This can include investing in stocks, bonds, mutual funds, or other vehicles.

Finally, it's important to periodically review and adjust the financial plan as circumstances change. This can include adjusting the budget or saving plan, re-evaluating investment choices, or revisiting financial goals in light of changing circumstances. By following this flow chart, individuals can take control of their finances and work towards achieving their financial goals.

What are the advantages of using this flowchart?

The advantages of using this flowchart are numerous. First, it provides a clear and structured approach to financial planning, which can be helpful for individuals who may not know where to start. By following the steps outlined in the flowchart, individuals can be sure they are covering all the important aspects of financial planning. Additionally, the flowchart emphasizes the importance of setting and prioritizing financial goals, creating a budget, and developing a saving plan, which are all key components of financial success. By following the flowchart, individuals can also identify areas where they may need to make adjustments to their finances, such as paying off debt or adjusting their investment strategy. Finally, the flowchart emphasizes the importance of regularly reviewing and adjusting the financial plan, which can help individuals stay on track and adapt to changing circumstances.

Searching for some flowchart templates? Go to Visual Paradigm Online and select some designs for customization now!