Payout Ratio Calculator

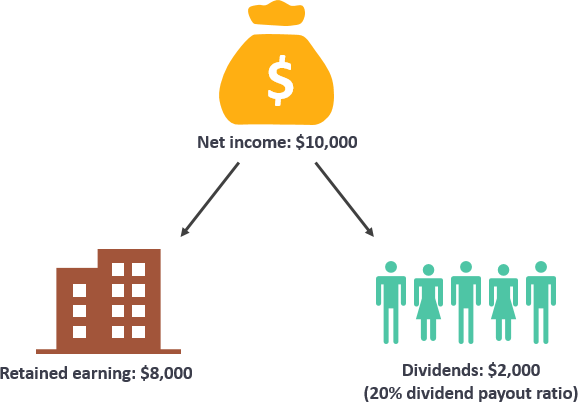

The payout ratio (also known as the dividend payout) is ratio is the percentage of net income that a company pays out as dividends to common shareholders. The part of earnings not paid to investors is left for investment to provide for future earnings growth.

High growth firms in early life generally have low or zero payout ratios. As they mature, they tend to return more of the earnings back to investors. The dividend payout ratio is calculated as DPS/EPS. Thus, some investors prefer high dividend payout, while some others prefer high capital growth:

- Investors seeking high current income and limited capital growth prefer companies with a high dividend payout ratio.

- Investors seeking capital growth may prefer a lower payout ratio because capital gains are taxed at a lower rate.

Note:

- A payout ratio over 100% indicates that the company is paying out more in dividends than its earning can support, which some view as an unsustainable practice.

- Some companies choose stock buybacks as an alternative to dividends; in such cases, this ratio becomes less meaningful.

Formula

- Payout Ratio = (Total Dividends Paid)/(Net Income)

- Payout Ratio = (Total Dividends (Common and Preferred) per Share)/(Earnings per Share)

Payout ratio calculation examples