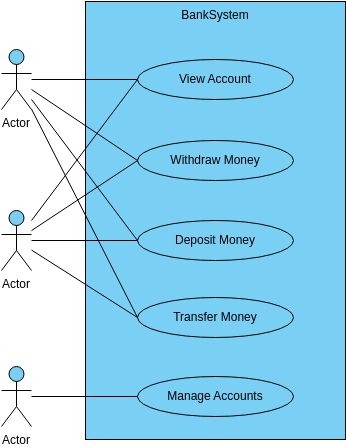

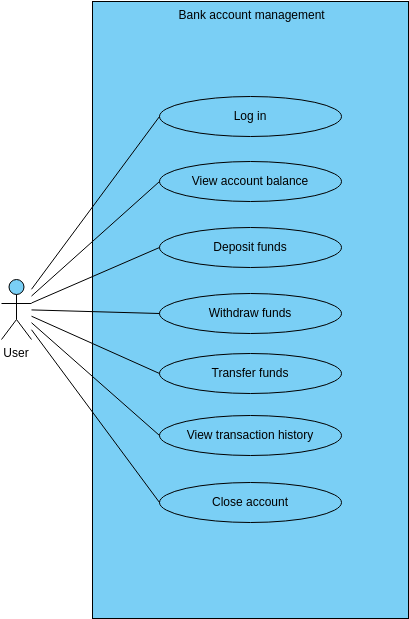

Banking system

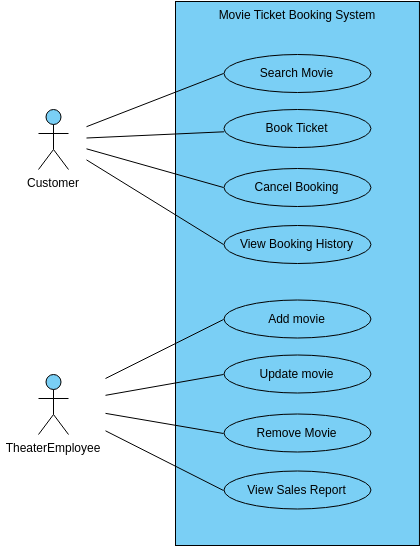

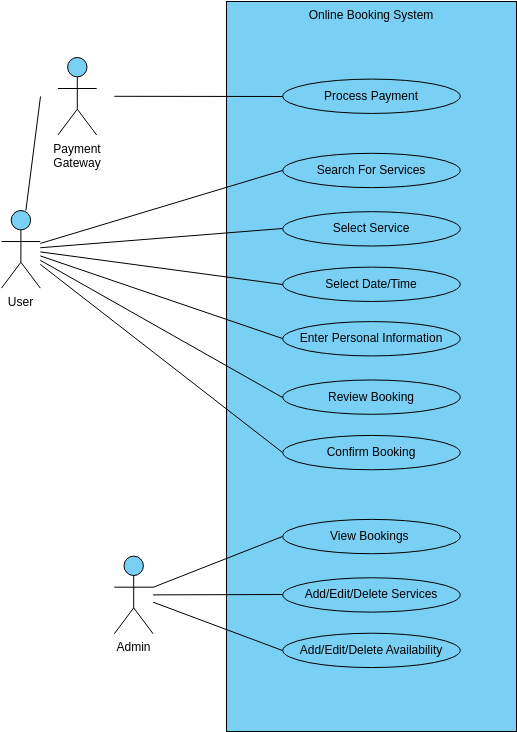

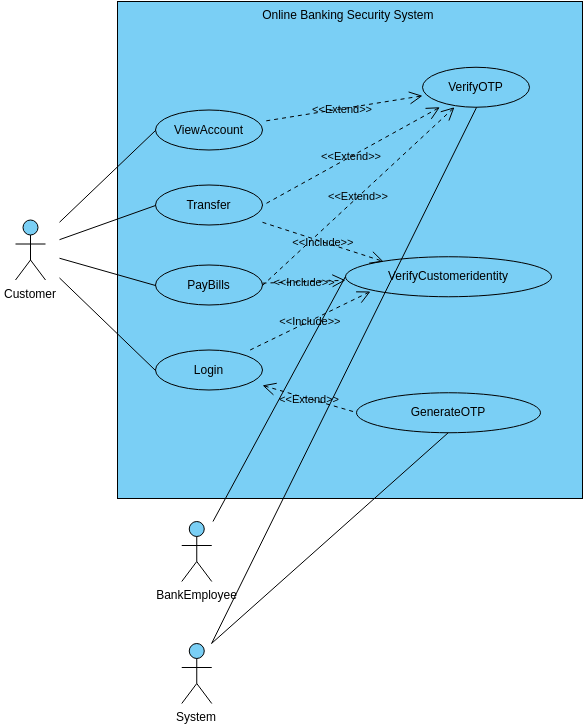

The Banking System is an essential tool for managing financial transactions, including account management, money transfers, and withdrawals and deposits. The system provides a centralized location for all banking-related information, making it easy for customers to access and manage their accounts at their convenience.

One of the primary features of the system is the ability to view account information. This feature allows customers to view their account balances, transaction history, and other account-related information. Additionally, the system allows customers to manage multiple accounts, making it easy to track and manage finances.

The system also offers the ability to withdraw and deposit money. Customers can withdraw money from their accounts using the system, either by visiting a bank branch or using an ATM. Similarly, customers can deposit money into their accounts, either by visiting a bank branch or using a mobile banking application. This feature ensures that customers can access their funds when they need them, regardless of their location.

Another essential feature of the system is the ability to transfer money. Customers can transfer money between their accounts or to other accounts using the system. This feature allows customers to send money to friends and family, pay bills, and conduct other financial transactions conveniently and securely.

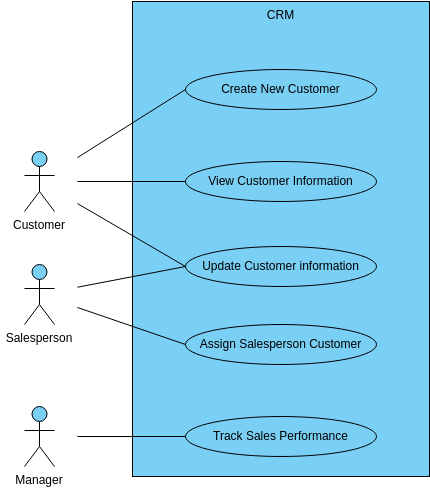

Finally, the system provides the ability to manage accounts. Bank staff can manage account information, such as customer contact information, account balances, and transaction history. Additionally, the system allows bank staff to monitor customer accounts for suspicious activity, ensuring that customer accounts remain secure.

In conclusion, the Banking System provides a range of features that enable customers to manage their finances efficiently and effectively. The system supports account management, money transfers, withdrawals and deposits, and account monitoring, providing a seamless experience for customers. The system is designed to be user-friendly and customizable, ensuring that customers can access and manage information according to their needs and preferences. The system also provides valuable insights into customer behavior and financial transactions, enabling bank staff to make informed decisions and improve customer service.

Benefits of creating this use case diagram

Creating a use case diagram for the Banking System provides several benefits for the project team and stakeholders. Firstly, the use case diagram helps to define the scope of the system and identify the key functionalities that it should provide. This makes it easier for the project team to prioritize tasks and allocate resources effectively. By understanding the needs and requirements of customers and bank staff, the team can develop a system that meets their expectations and provides a seamless user experience.

Secondly, the use case diagram helps to ensure that all stakeholders are on the same page when it comes to the system's functionality. This is important because stakeholders may have different expectations and interpretations of the system's scope. By clearly defining the system's functionalities and use cases, the project team can ensure that all stakeholders have a common understanding of what the system will do and how it will work. This can reduce misunderstandings and prevent delays or mistakes in the development process.

Moreover, a use case diagram serves as an essential communication tool between the project team and stakeholders. It allows the team to communicate the system's requirements and functionality in a clear and concise manner that is easily understood by stakeholders. By doing this, stakeholders can provide feedback on the system's functionality, which the project team can use to improve the system's design and make it more user-friendly. This feedback loop ensures that the system meets the needs and expectations of customers and bank staff, resulting in a more successful implementation. Overall, creating a robust use case diagram for the Banking System ensures that the system is developed in a consistent and coherent manner, satisfying the needs of both customers and bank staff, and delivering value to stakeholders.

Searching for some use case templates? Go to Visual Paradigm Online and select some designs for customization now!