Depreciation is an important concept for businesses to understand when it comes to accounting for their assets. There are various methods used to calculate depreciation, including the straight-line method, declining balance method, and sum-of-the-years’ digits method. Each of these methods has its own pros and cons, and it’s important to understand which one is right for your business.

If you’re looking to compare the different depreciation methods, a great tool to use is the Visual Paradigm Depreciation Method Comparison Excel Template. This template provides a simple and easy-to-use interface for comparing the different methods and determining which one is right for your business.

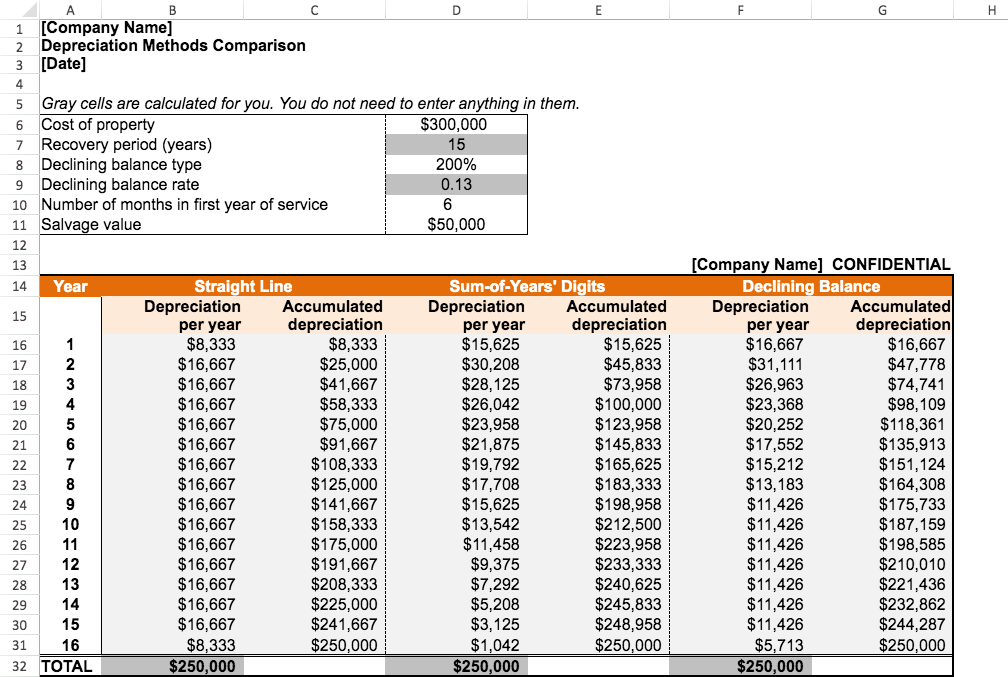

The template allows you to input your asset information and compare the results of each method, making it easy to see the differences in the amount of depreciation charged over time. This can help you make informed decisions about your business finances and help you understand how depreciation will impact your assets over time.

In conclusion, when it comes to comparing depreciation methods, it’s important to understand the pros and cons of each method. The Visual Paradigm Depreciation Method Comparison Excel Template provides a simple and effective way to compare the different methods and make informed decisions about your business finances. Whether you’re a small business owner or a finance professional, this template is a must-have tool for managing your assets effectively.