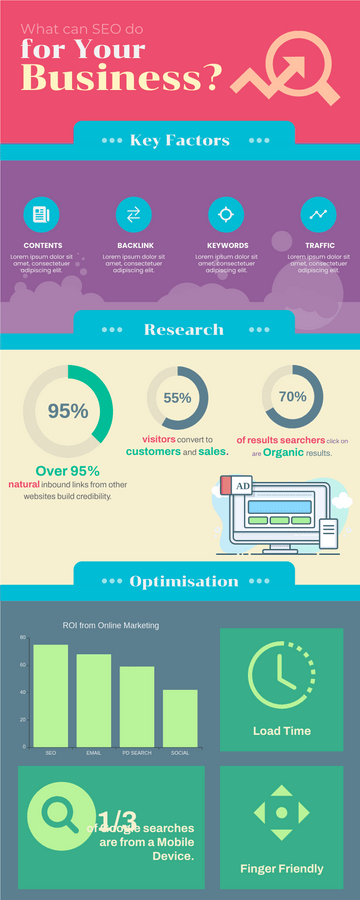

Berkshire Hathaway's Shareholder Meeting 2021 Infographic

11 highlights from Berkshire Hathaway's 2021 annual shareholder meeting

Buffett and Munger, chairman and vice chairman of Berkshire Hathaway, attended the company's annual shareholders' meeting in early May and responded to shareholders' questions. Here are the investment points they mentioned at the meeting:

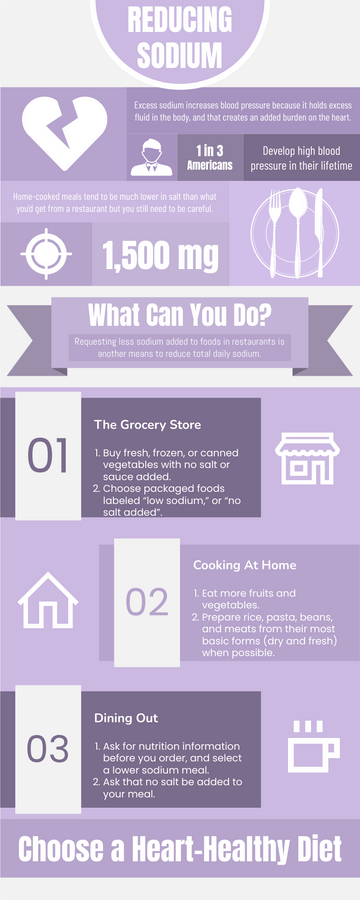

The U.S. economy is recovering well

Berkshire has been struggling to find a major acquisition

It was a bad decision to sell Apple

Will not repurchase airline stocks

U.S. bank sector is not a bad investment

For individual investors, index funds may be a good choice

Buffet dislikes Bitcoin

We still need hydrocarbon fuel

Greg Abel - Warren Buffett's successor

Raising corporate taxes may not be that bad

The world will still need hydrocarbon fuels for a long time to come