What is a Credit Dispute Letter and Why Do You Need One?

In today’s world, credit scores play a significant role in determining one’s financial health. Having a good credit score opens up various opportunities, such as better interest rates, credit card approvals, and even job opportunities. However, a single mistake or error on your credit report can negatively impact your credit score and ultimately your financial future. This is where a credit dispute letter can come in handy.

The Importance of Reviewing Your Credit Report

It is essential to review your credit report periodically and ensure that all the information reported is accurate. Mistakes and inaccuracies can occur due to various reasons, including clerical errors, identity theft, or outdated information. These errors can have a significant impact on your creditworthiness and financial well-being. Therefore, it is crucial to identify and rectify any inaccuracies promptly.

Understanding the Credit Dispute Letter

A credit dispute letter is a formal document that requests the removal of inaccurate or outdated information from your credit report. It serves as a means to communicate with credit reporting agencies and dispute any errors you have identified. By submitting a credit dispute letter, you are exercising your rights under the Fair Credit Reporting Act (FCRA) to ensure the accuracy of your credit report.

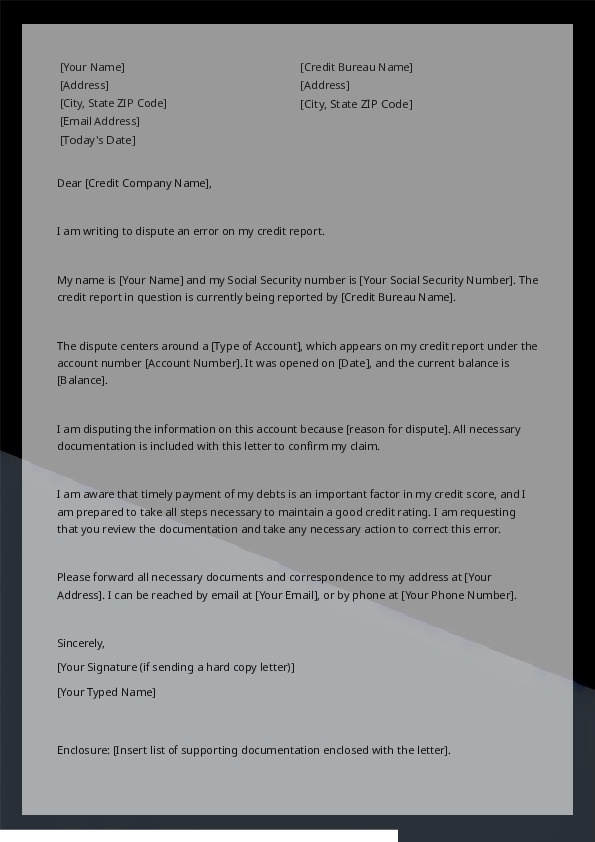

Simplifying the Process with Our Credit Dispute Letter Template

The process of writing a credit dispute letter can be daunting, especially if you are not familiar with the technical jargon and legal requirements. However, our website is here to simplify the process for you. We have created a user-friendly credit dispute letter template that is comprehensive and easy to understand.

Key Features of Our Credit Dispute Letter Template

- Concise and Professional Format: Our template follows a structured format to ensure that your letter is clear, concise, and professional. This helps to convey your message effectively and increase the chances of a successful dispute.

- Complete and Accurate Information: Our template includes all the necessary information required in a credit dispute letter. This includes details such as the credit reporting agency’s name, the disputed information, and the reason for the dispute. By providing accurate and specific information, you strengthen your case and make it easier for the credit reporting agency to investigate and rectify the error.

- Supporting Documents Section: Our template includes a section for attaching supporting documents. This allows you to provide additional evidence or documentation to support your dispute. Including relevant documents can help strengthen your case and improve the chances of a successful resolution.

- Timeline for Response: Our template also includes a timeline for the credit reporting agency to respond to your dispute. This ensures that you have a clear expectation of when you should receive a response. It also provides a framework for following up if the agency fails to respond within the specified timeframe.

Engage Your Audience with Our Dynamic Online Presentation Software!

Ready to captivate your audience and make a lasting impression? Look no further! Our friendly and feature-rich Online Presentation Software at Visual Paradigm Online is here to help you effortlessly design stunning slideshows and demos. With our intuitive interface and a wide range of editing tools and animation effects, creating impactful presentations has never been easier. Sign up for free and start creating visually stunning presentations that will wow your audience!