LBO Valuation: Understanding the Key Metrics

LBO, or Leveraged Buyout, is a common financial strategy used by companies and investors to acquire other businesses. The process involves financing a significant portion of the purchase price through debt, which is then paid off using the acquired company’s future cash flows. The key to a successful LBO lies in accurately valuing the target company, which is where LBO valuation comes in.

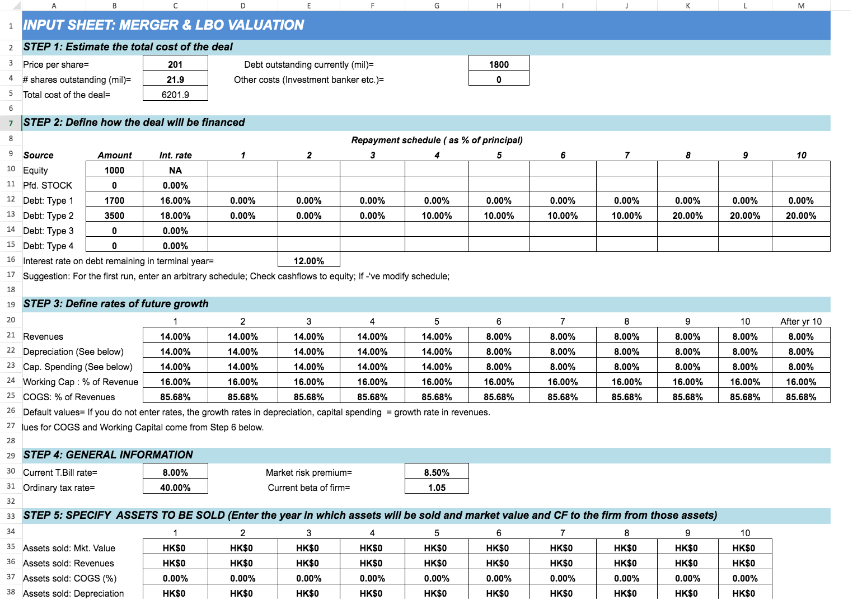

LBO valuation is a complex process that involves analyzing several financial metrics to determine the value of a company. Some of the key metrics used in LBO valuation include cash flows, debt levels, and the cost of capital. By analyzing these metrics, financial professionals can determine the value of a company and determine if it is a viable investment opportunity.

Visual Paradigm LBO Valuation Excel Templates: A Simple Solution

For those who are not financial experts, understanding the complex calculations involved in LBO valuation can be a challenge. That’s why Visual Paradigm has created a suite of LBO valuation excel templates that make the process much simpler. Our templates include pre-built financial models and easy-to-use spreadsheets that take the complexity out of the equation.

Our LBO valuation excel templates include everything you need to analyze the financial metrics of a company, including pre-populated formulas and customizable worksheets. Whether you’re a financial analyst, an investor, or a business owner, our templates are the perfect solution for anyone who needs to perform LBO valuation quickly and accurately.

So, if you’re looking for a simple solution to LBO valuation, look no further than Visual Paradigm. Our excel templates are designed to be user-friendly and accessible, making it easy for anyone to perform LBO valuation with confidence.