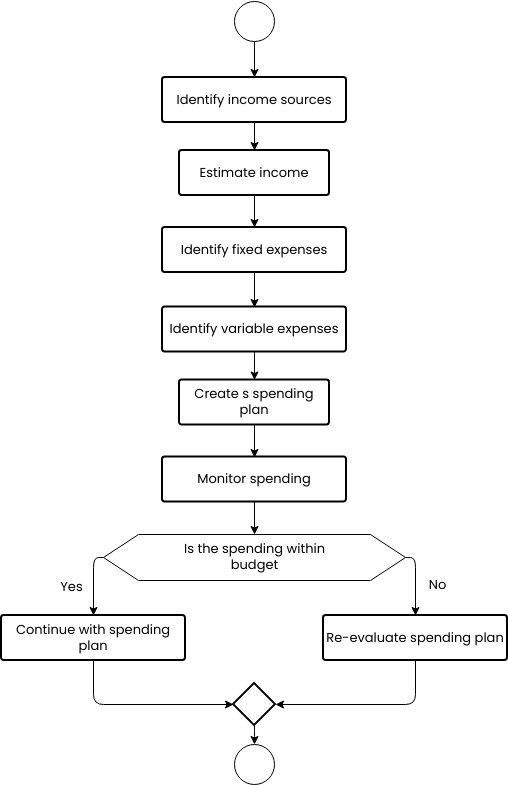

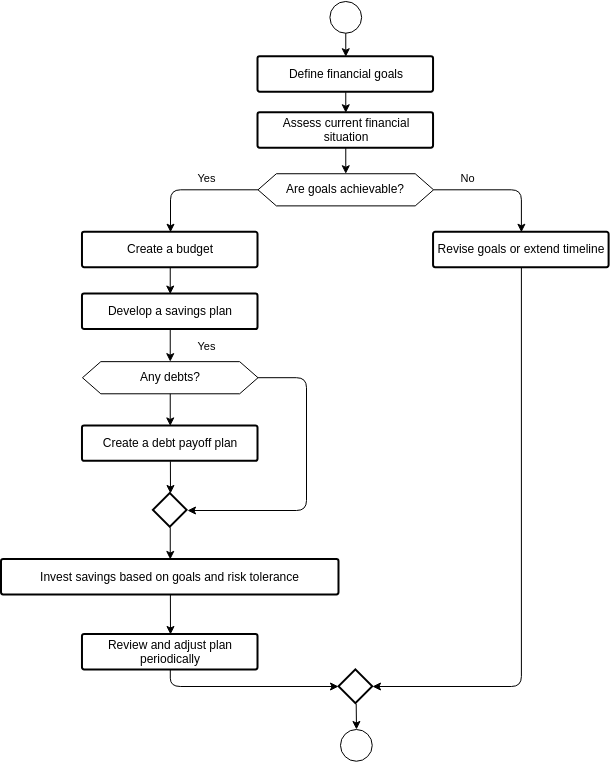

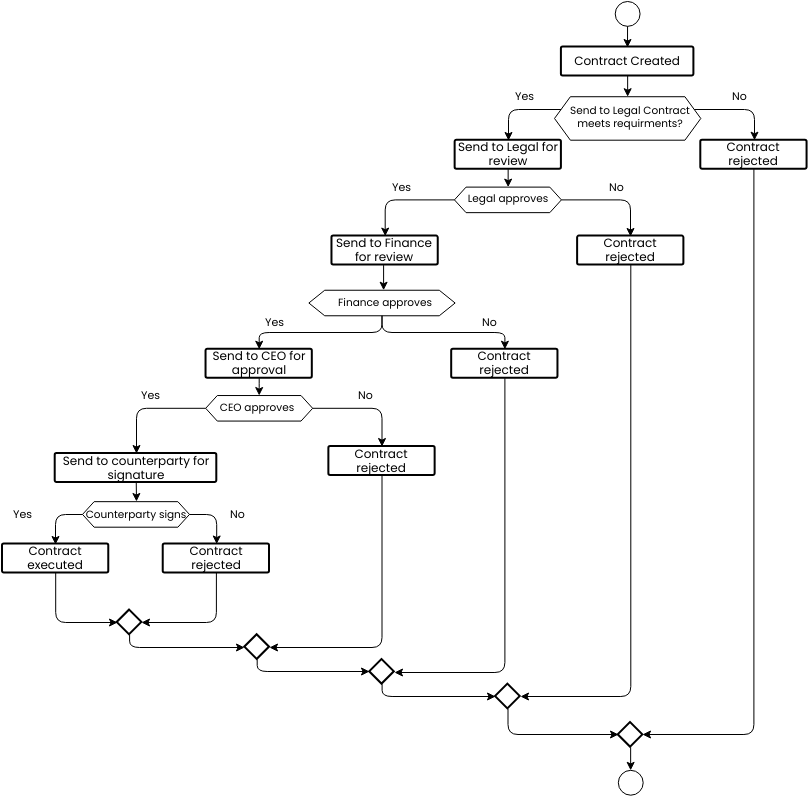

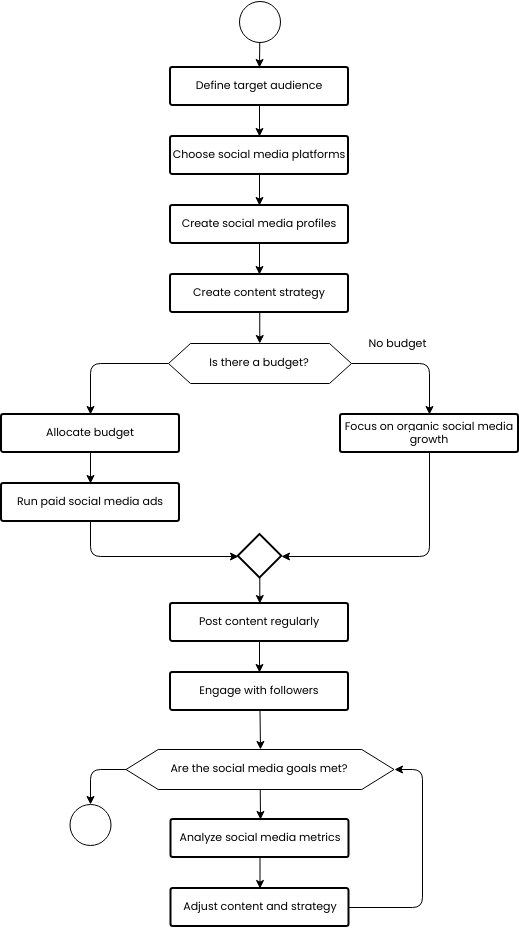

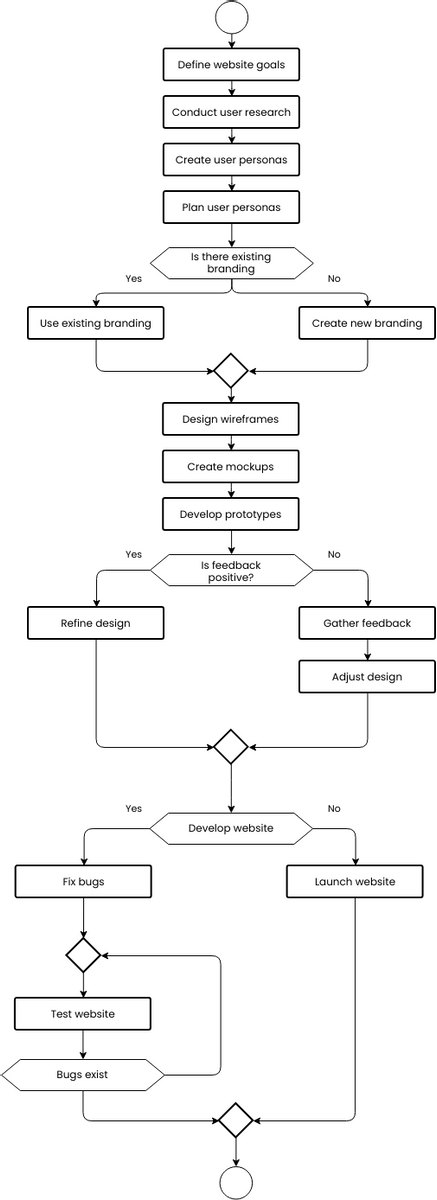

Budgeting process flowchart

The Budgeting process flowchart outlines the steps involved in creating and managing a household budget. The first step is to identify income sources, which involves determining all sources of income.

The next step is to estimate income, which involves calculating the total amount of income expected for the budgeting period. This may involve looking at past income statements or projecting future income.

Once income has been estimated, the next step is to identify fixed expenses. Fixed expenses are expenses that remain the same from month to month, such as rent or mortgage payments, car payments, and insurance premiums.

The next step is to identify variable expenses, which are expenses that vary from month to month, such as groceries, utilities, and entertainment expenses. These expenses may be more difficult to predict than fixed expenses, but can be estimated based on past spending patterns.

Once all income and expenses have been identified, the next step is to create a spending plan. This involves allocating income to cover fixed and variable expenses and setting aside money for savings or debt repayment.

In conclusion, following the steps outlined in the Budgeting process flowchart can help individuals and households to create and manage an effective budget. By identifying income sources, estimating income, and identifying fixed and variable expenses, individuals can create a spending plan that covers all necessary expenses while still leaving room for savings or debt repayment. By monitoring spending and regularly re-evaluating the spending plan, individuals can ensure that they are on track to meet their financial goals and maintain financial stability. An effective budget can help individuals to manage their finances better, reduce stress, and achieve financial goals.

Why is it important to create budgeting process flowchart?

Creating a budgeting process flowchart is important as it provides an organized and structured approach to budgeting, facilitates effective communication, encourages consistency and accuracy, identifies potential issues, and provides a framework for monitoring and evaluation. By following a well-designed budgeting process flowchart, individuals can effectively manage their finances and achieve their financial goals.