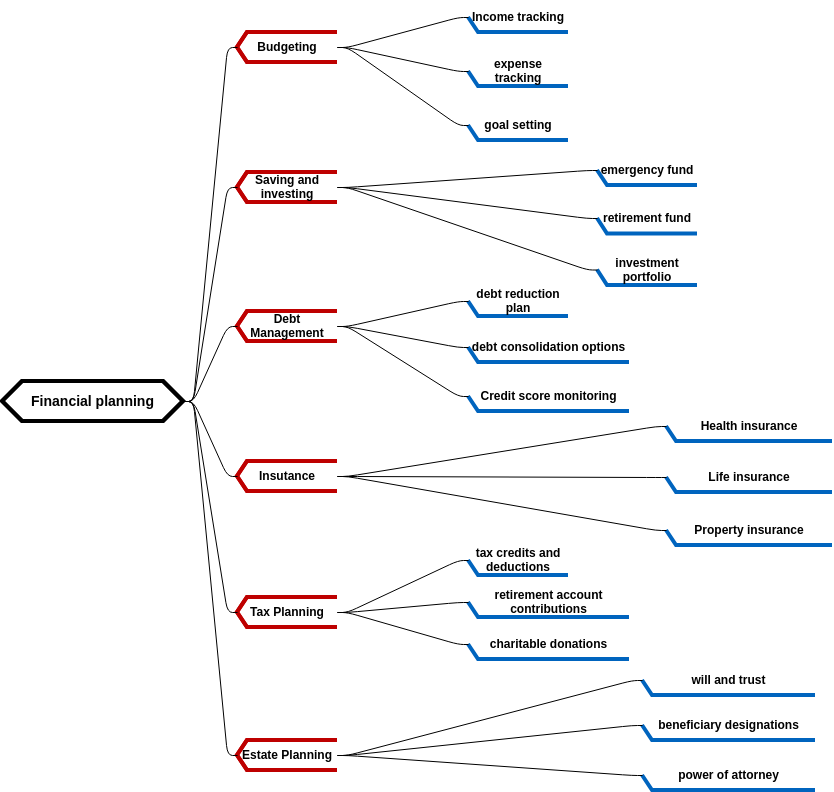

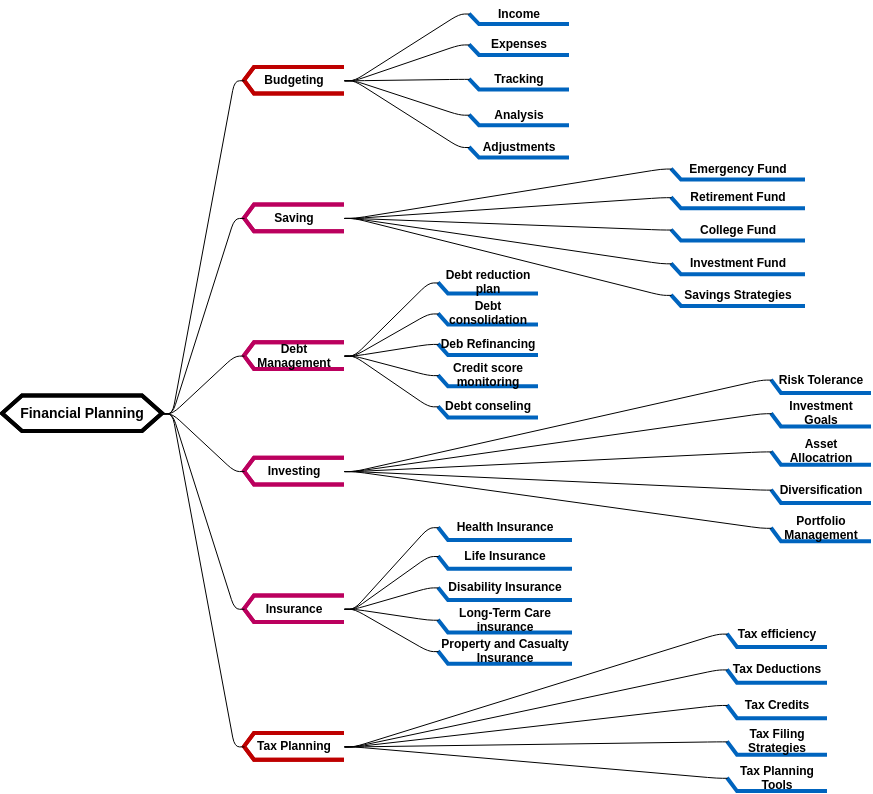

This mind map provides a comprehensive overview of the key components of financial planning. It starts with budgeting, which is the foundation of any financial plan. Budgeting involves tracking your income and expenses to create a plan for how you will spend your money. By understanding your cash flow, you can make informed decisions about your spending and saving habits. Budgeting is an important tool for achieving your financial goals, whether that's paying off debt, saving for a down payment on a house, or investing for retirement.

The mind map then covers various other important aspects of financial planning, including income tracking, saving and investing, emergency funds, debt management, insurance, tax planning, retirement account contributions, and estate planning. Each of these topics is interconnected and plays an important role in achieving your financial goals. For example, saving and investing are critical for building wealth over time, while debt management and insurance are important for protecting your assets. Tax planning can help you minimize your tax liability and keep more of your hard-earned money, and estate planning ensures that your assets are distributed according to your wishes after you pass away.

One important aspect of financial planning that the mind map covers is emergency funds. An emergency fund is a savings account that you can use to cover unexpected expenses, such as a medical emergency or job loss. Having an emergency fund can help you avoid going into debt when unexpected expenses arise, and it can provide peace of mind knowing that you have a financial cushion. The mind map also covers debt management and debt reduction plans, which are important for paying off any outstanding debts you may have. By creating a debt reduction plan, you can prioritize paying off high-interest debts first and work towards becoming debt-free.

Pros of creating this mind map

Creating a mind map for financial planning has several benefits. First, it can help you visualize the different components of your financial plan and how they are interconnected. By seeing the big picture, you can better understand how each piece fits together and make informed decisions about your finances. This can help you stay organized and focused on your financial goals. For example, if you're working on paying off debt, you can use the mind map to create a debt reduction plan that takes into account your budget, income, and other financial goals.

Second, creating a mind map for financial planning can help you identify any gaps or areas where you need to focus more attention. For example, if you haven't yet set up an emergency fund, the mind map can remind you of its importance and prompt you to take action. By addressing any gaps in your financial plan, you can ensure that you're well-prepared for any unexpected expenses or changes in your financial situation. This can help you avoid financial stress and build greater financial resilience over time.

Overall, creating a mind map for financial planning is a useful tool for anyone who wants to take control of their finances and achieve their financial goals. By visualizing your financial plan, you can better understand how each component fits together and identify any areas where you need to focus more attention. With a solid financial plan in place, you can build greater financial security and peace of mind for yourself and your loved ones.