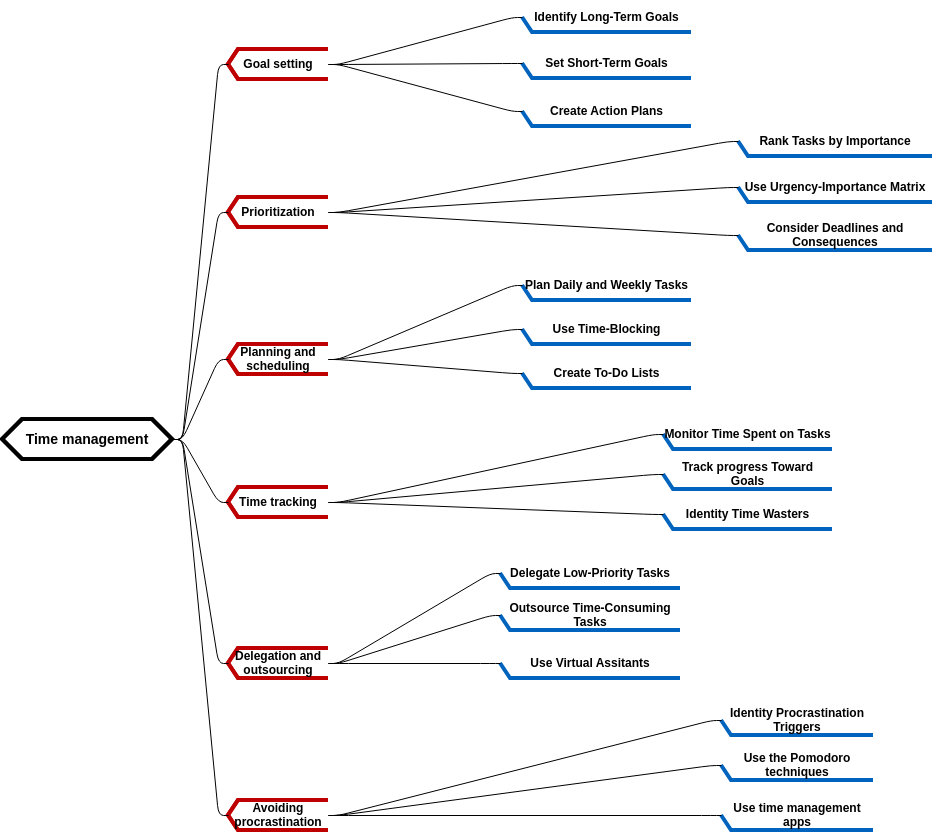

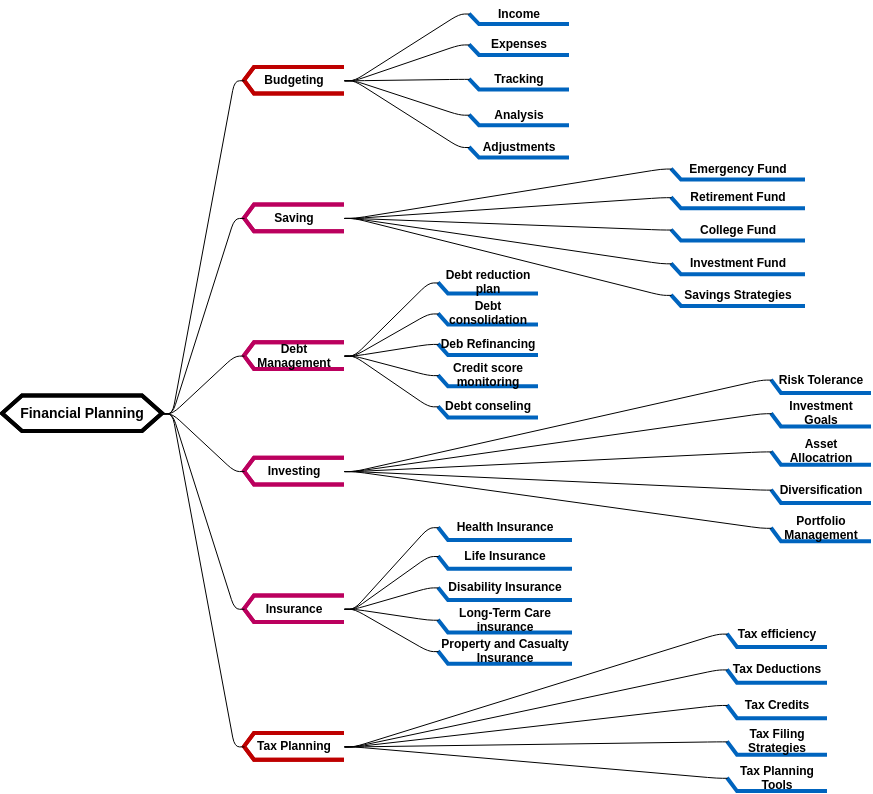

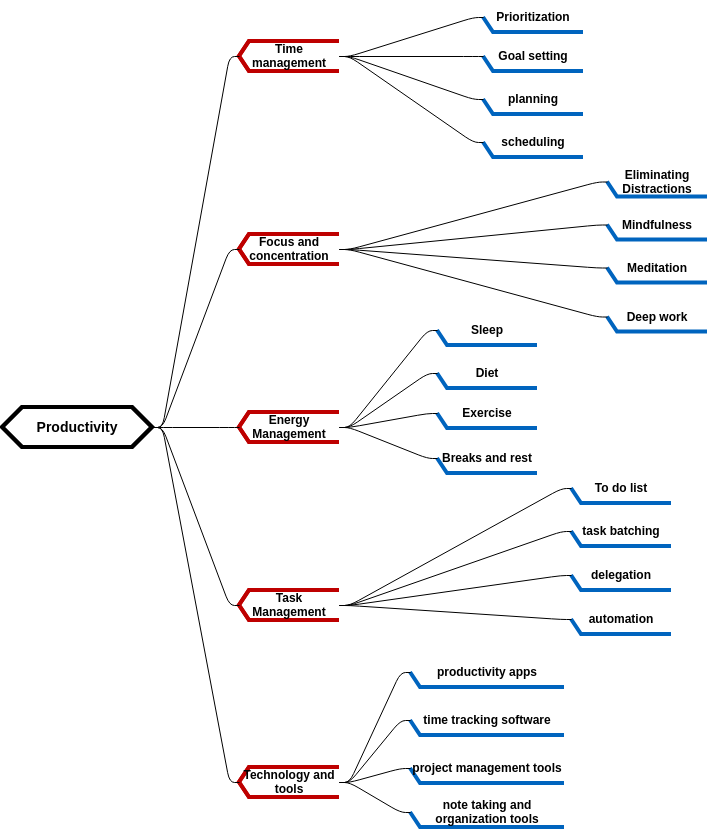

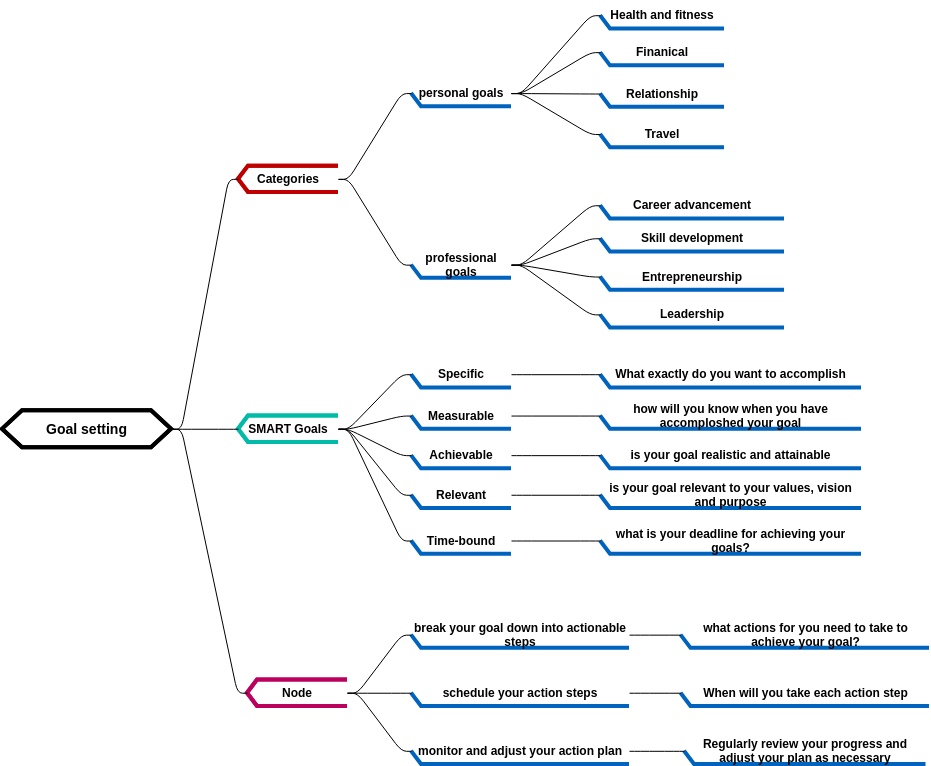

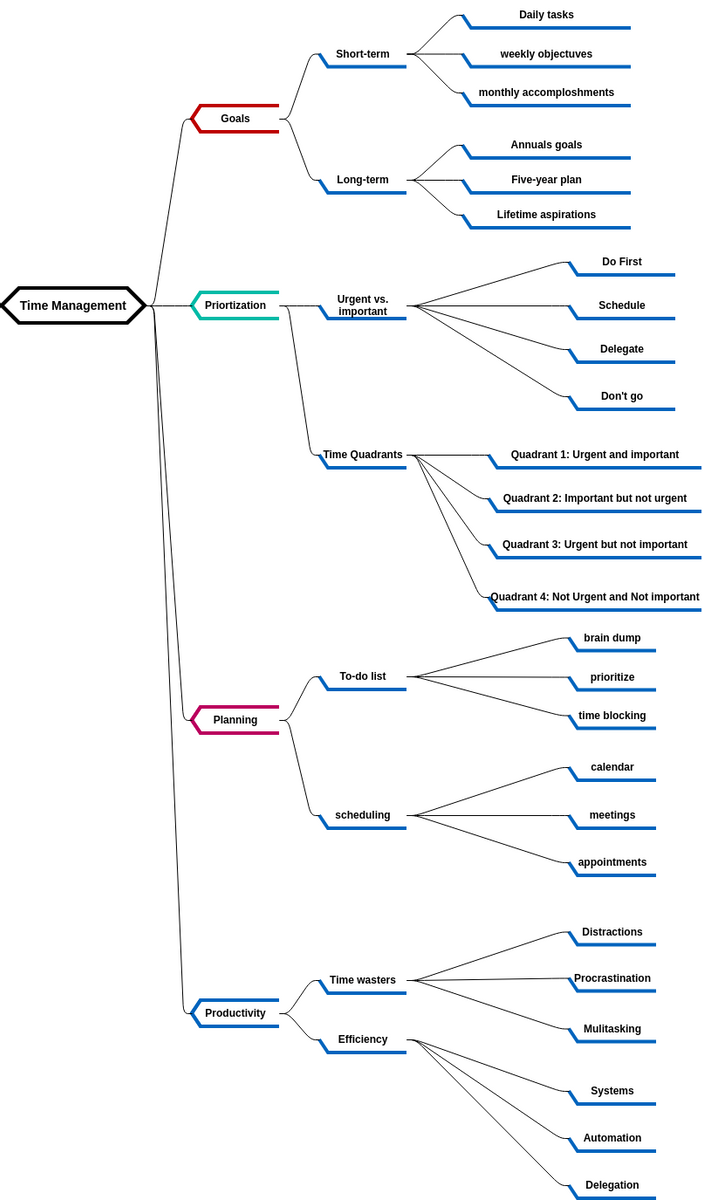

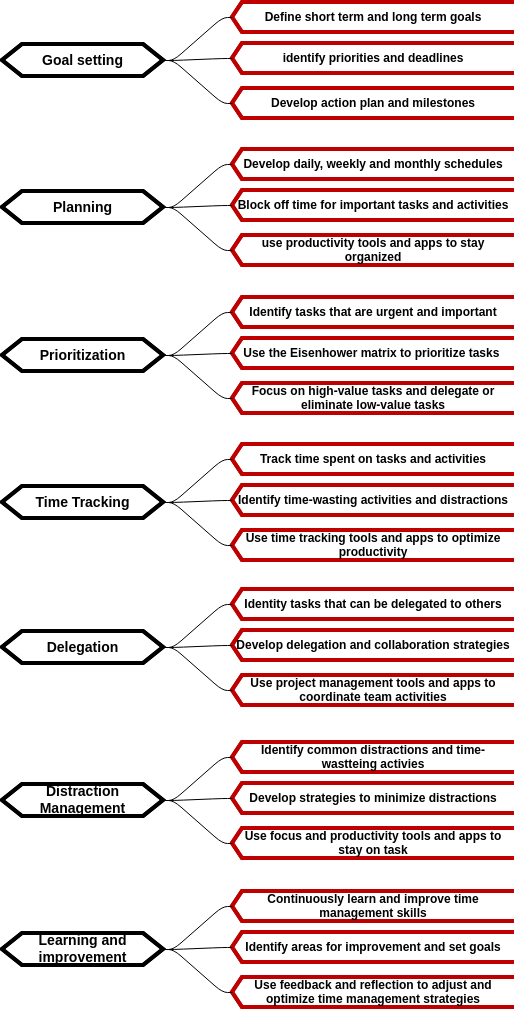

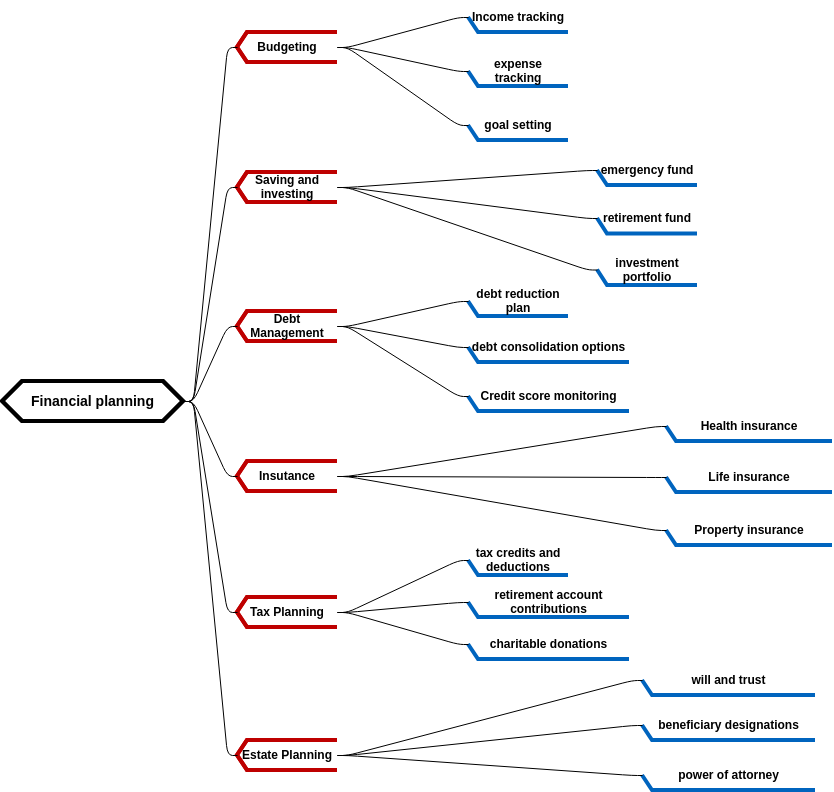

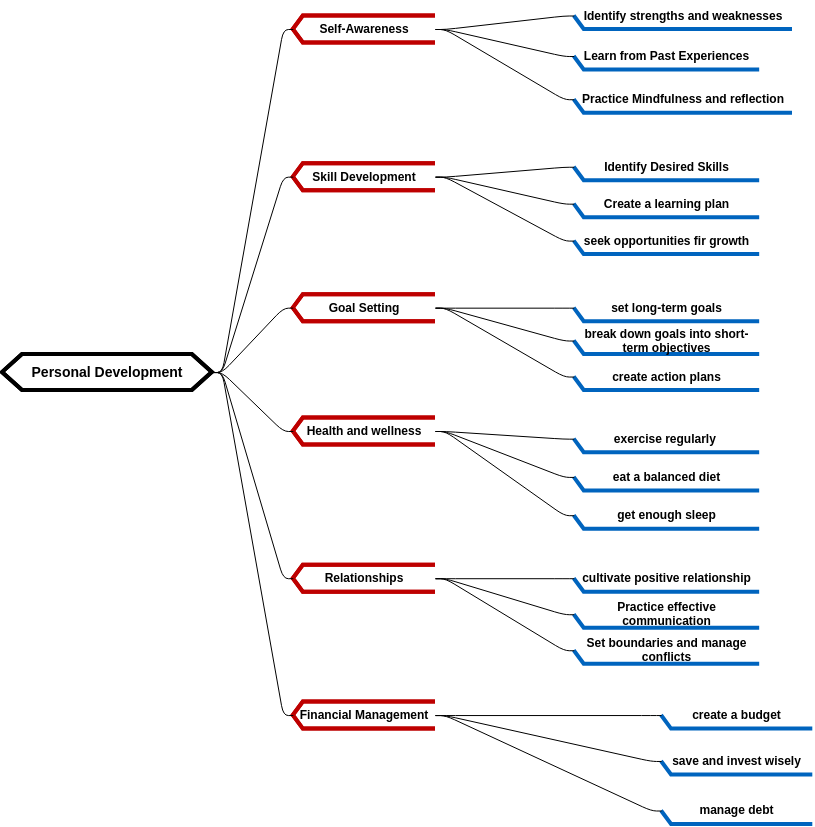

This mind map provides a useful framework for organizing and prioritizing financial planning tasks. The first section of the mind map is goal setting, which involves identifying your financial goals and determining the steps needed to achieve them. Setting short-term goals can help you make progress towards your larger financial goals and stay motivated along the way.

The next section of the mind map is prioritization, which involves using the urgency-importance matrix to prioritize your financial tasks. This matrix helps you identify which tasks are most urgent and important, and which can be delayed or delegated. By focusing on the most urgent and important tasks first, you can make efficient use of your time and stay on track towards your goals.

The planning and scheduling section of the mind map includes time-blocking and time tracking. Time-blocking involves scheduling specific blocks of time for each financial task, such as budgeting or paying bills. This can help you stay focused and avoid distractions while working on your financial goals. Time tracking involves keeping track of how much time you spend on each financial task, which can help you identify areas where you may need to adjust your priorities or increase your efficiency.

The final section of the mind map is tracking progress toward goals. This involves regularly reviewing your progress and adjusting your plan as needed. By tracking your progress, you can stay motivated and make adjustments to your plan if you're falling behind. Overall, this mind map provides a useful framework for organizing and prioritizing financial planning tasks, helping you stay on track towards your financial goals.

Benefits of creating this mind map

Creating a mind map for financial planning can provide several benefits. Firstly, it can help you stay organized and focused on your financial goals. By breaking down financial planning tasks into smaller components and organizing them in a visual way, you can gain a better understanding of how each task fits into your overall financial plan. This can help you stay motivated and on track towards achieving your financial goals.

Secondly, creating a mind map for financial planning can help you prioritize your financial tasks and make efficient use of your time. By using tools such as the urgency-importance matrix and time-blocking, you can identify which tasks are most urgent and important, and schedule specific blocks of time to work on each task. This can help you avoid procrastination and stay focused on the most important tasks, while also making efficient use of your time. By tracking your progress towards your financial goals, you can identify areas where you may need to adjust your priorities or increase your efficiency, helping you stay on track towards achieving your financial goals.