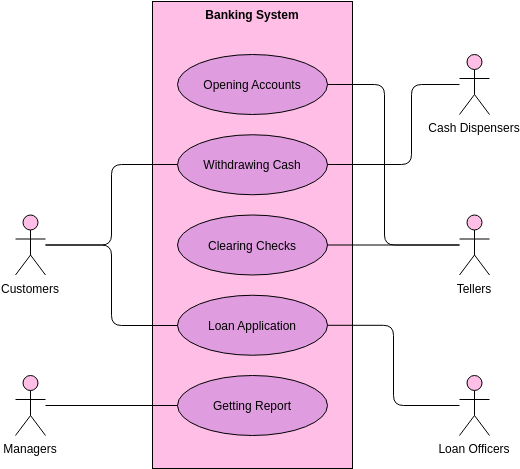

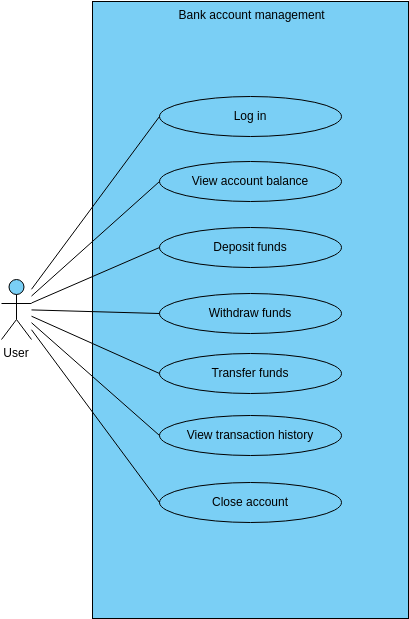

The Banking System use case model represents the different actions that a user can perform while interacting with a banking system. The first use case, Opening Accounts, allows a user to open a new account with the bank. This use case is essential as it enables the bank to attract new customers and allows the user to access various banking services such as depositing, withdrawing, and transferring funds.

The second use case, Withdrawing Cash, allows a user to withdraw cash from their account. This use case is crucial as it enables the user to access their funds whenever they need them. The user can withdraw cash from an ATM or at the bank counter, depending on their preference. This use case also allows the user to keep track of their account balance and ensures that they have sufficient funds to withdraw.

The third use case, Clearing Checks, allows a user to deposit a check into their account. This use case is important as it enables the user to receive payments from others and deposit them into their account. The bank verifies the check and credits the user's account with the appropriate amount. This use case also allows the user to keep track of their transactions and manage their finances effectively.

The fourth use case, Loan Application, allows a user to apply for a loan from the bank. This use case is essential as it enables the user to access credit when they need it. The user can apply for various types of loans such as personal loans, home loans, or business loans. The bank verifies the user's creditworthiness and approves the loan if they meet the necessary criteria.

Advantages of creating this diagram

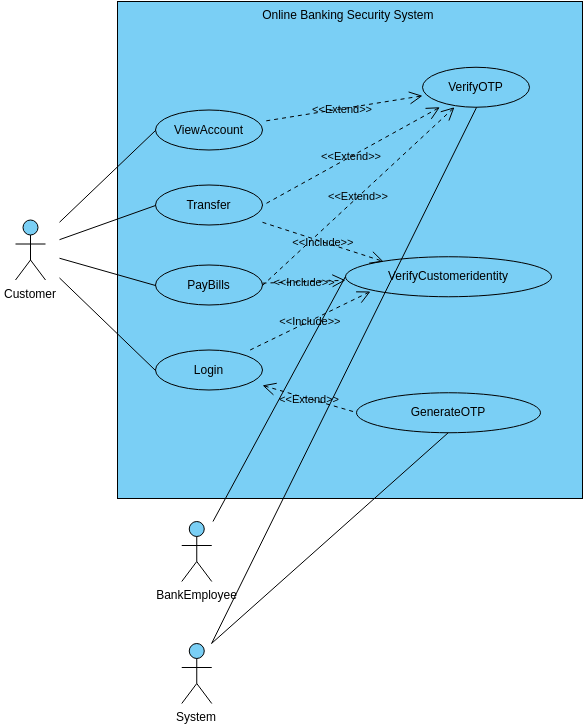

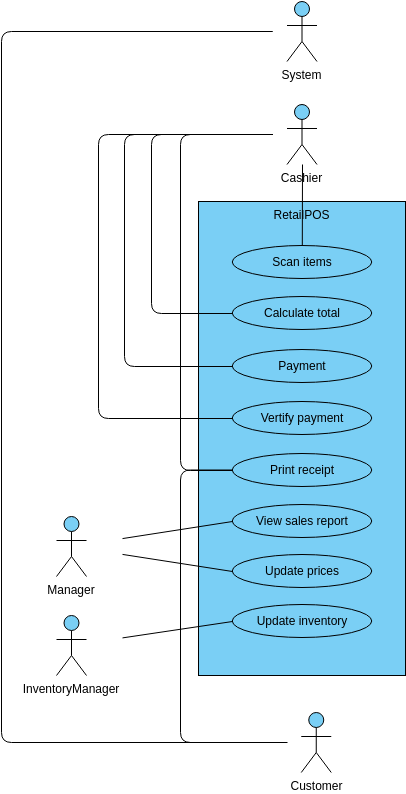

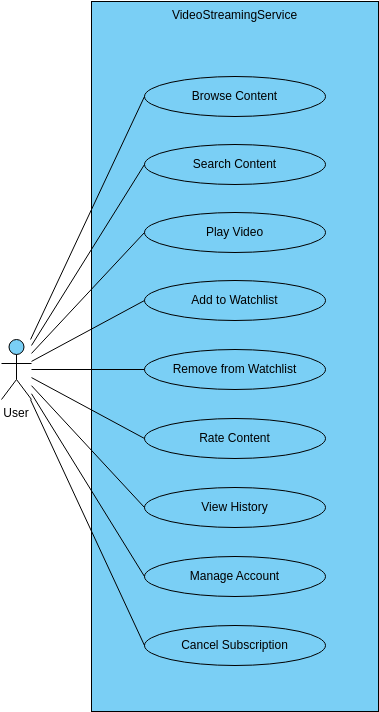

Creating a use case model, such as the Banking System diagram, provides several advantages for the development of a banking system. Firstly, it helps to identify all the different functionalities that the banking system needs to have. This enables developers to design and implement the system in a structured and organized manner, ensuring that all important features are included. It also helps them to prioritize features based on their significance and relevance to users.

Secondly, a use case model helps to understand the interactions between users and the system. It enables developers to identify potential issues and challenges that users may face while using the banking system. This can help them to design solutions that can address these issues and make the system more user-friendly, efficient, and effective. Overall, creating a use case model ensures that the banking system is designed and developed with the end-users in mind, leading to a better user experience and increased user satisfaction.

In addition, a use case model can be used as a basis for testing and validating the banking system. The use cases can be used as test cases to ensure that the system is functioning correctly and efficiently. In addition, the use case model can be used to validate the system's behavior and ensure that it meets the user's requirements and expectations. By testing the system against the use cases, developers can identify any issues or bugs that need to be fixed, ensuring that the system is stable and robust when it is deployed to production.