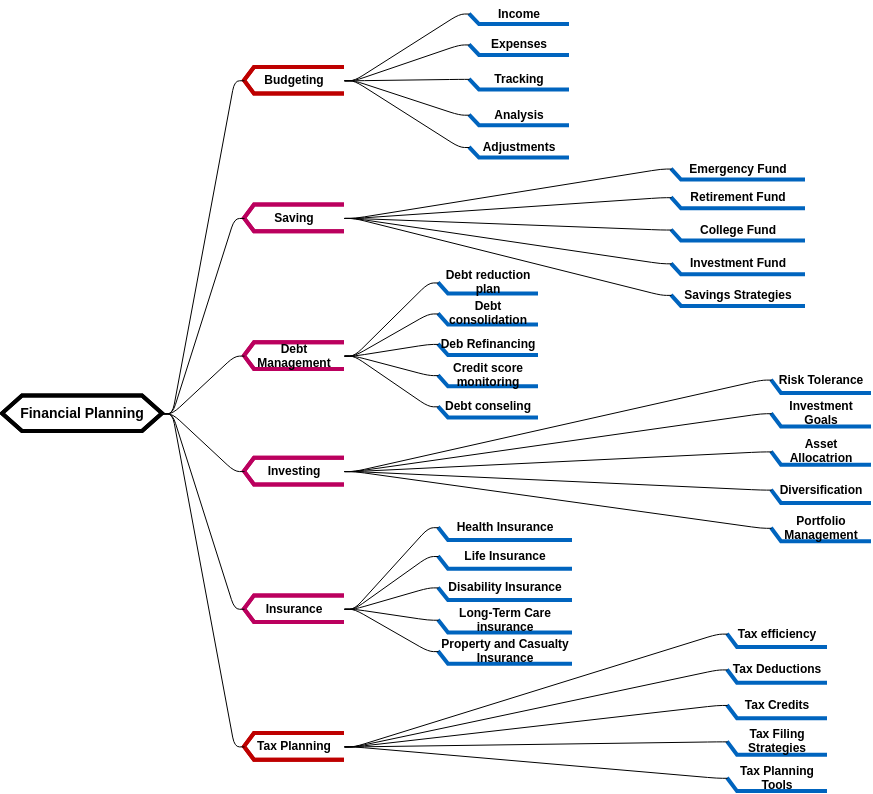

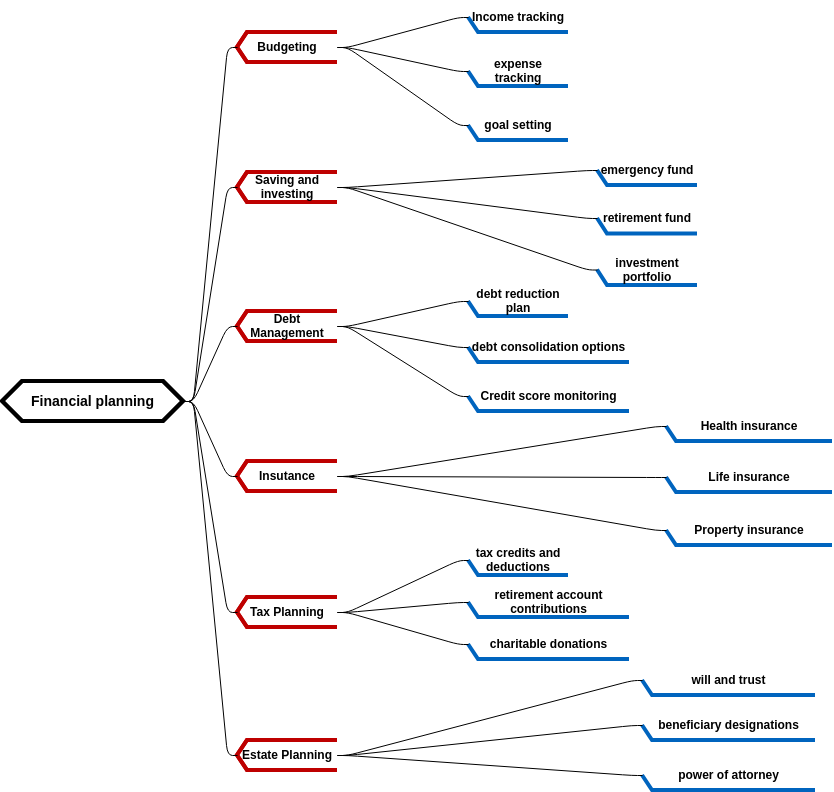

The financial planning mind map is a comprehensive tool that can help individuals and families to manage their finances effectively. The mind map starts with budgeting, which involves creating a spending plan that reflects an individual's income and expenses. This is a critical component of financial planning, as it helps individuals to live within their means and avoid overspending. Tracking expenses is also an important component of financial planning, as it helps individuals to identify areas where they can reduce spending and save money.

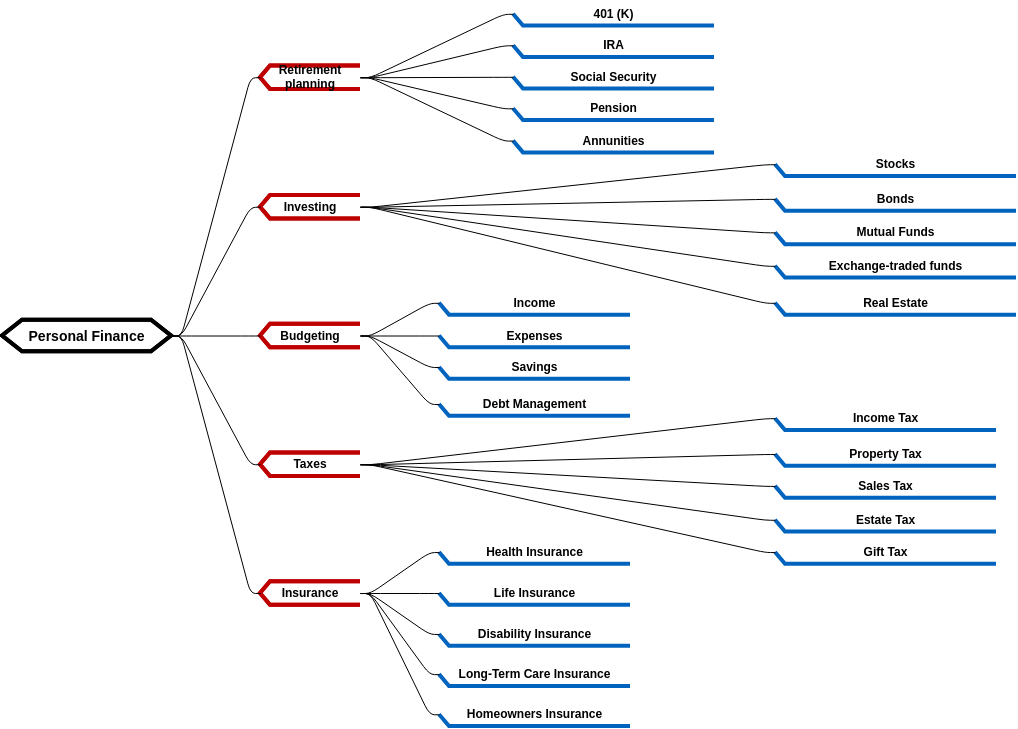

The mind map also includes saving and investing as important components of financial planning. Saving involves setting aside money for future needs, such as emergencies or retirement. Investing involves putting money to work in order to generate returns over time. The mind map emphasizes the importance of diversification in investing, which involves spreading investments across different asset classes in order to reduce risk. The mind map also includes a college fund as a specific type of savings goal, which can help families to plan for the costs associated with higher education.

Debt management is another important component of financial planning, and the mind map includes debt consolidation as a strategy for managing debt. Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can help individuals to simplify their debt management and reduce the amount of interest they pay over time. The mind map also includes disability insurance as a type of insurance that can help individuals to protect their income in the event of a disability.

The mind map also includes tax deductions as an important consideration in financial planning. Tax deductions can help individuals to reduce their taxable income and save money on taxes. The mind map emphasizes the importance of understanding the tax code and taking advantage of all available deductions. Finally, the mind map includes insurance as a critical component of financial planning. Insurance can help individuals to protect their assets and income in the event of unexpected events such as illness, injury, or death. The mind map includes various types of insurance, such as life insurance, health insurance, and disability insurance.

Benefits of creating this mind map

Creating a financial planning mind map can have several benefits. First, it can provide a comprehensive overview of an individual's financial situation, including income, expenses, debt, and assets. By having a clear and complete understanding of their financial situation, individuals can identify areas where they can make improvements, such as reducing spending or increasing savings. The mind map can also help individuals to set and prioritize financial goals, such as paying off debt or saving for retirement. By breaking down the financial planning process into its component parts, individuals can more easily identify the steps they need to take in order to achieve their goals.

Another benefit of creating a financial planning mind map is that it can help individuals to make informed financial decisions. By including information about budgeting, tracking expenses, saving, investing, and debt management, the mind map can help individuals to make decisions that are based on a thorough analysis of their financial situation. This can help to minimize the risk of making impulsive or uninformed decisions that could have negative financial consequences. In addition, by including information about insurance and tax deductions, the mind map can help individuals to protect their assets and income and maximize their savings. Overall, the financial planning mind map can be a valuable tool for individuals and families who want to take control of their finances and make informed financial decisions.