Capital budgeting analysis is the process of evaluating an organization’s investment opportunities in long-term assets, such as equipment, buildings, and property. The goal of this analysis is to determine whether a proposed investment will provide a positive return and help the organization reach its financial goals.

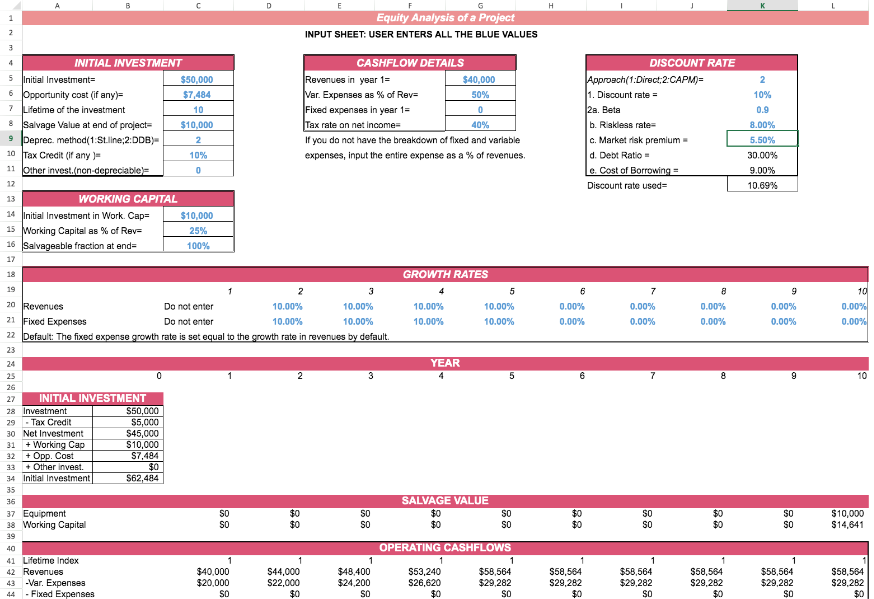

Our capital budgeting analysis excel templates, hosted on our website, are designed to make this process easier and more efficient. These templates provide a customizable and user-friendly platform for performing various financial calculations, including net present value (NPV), internal rate of return (IRR), and payback period. With these templates, you can easily input data, such as cash flows and discount rates, and quickly generate an analysis that helps you make informed investment decisions.

The benefits of using our Visual Paradigm capital budgeting analysis excel templates include:

- Streamlined calculations: With our templates, you can perform complex financial calculations with ease, without the need for manual formulas or specialized software.

- Increased accuracy: Our templates provide a reliable and consistent platform for performing calculations, reducing the risk of errors or inaccuracies.

- Time savings: You can save valuable time by using our templates, as they eliminate the need to manually create financial models or perform calculations.

- Improved decision-making: With our templates, you can quickly and easily generate an analysis that provides a clear and concise picture of the potential investment, helping you make informed investment decisions.

Overall, our capital budgeting analysis excel templates provide a simple, efficient, and reliable platform for performing financial analysis, making it easier for organizations to make informed investment decisions.